- Home

- >

- Stocks Daily Forecasts

- >

- German’s economy is silently preparing for a recession

German's economy is silently preparing for a recession

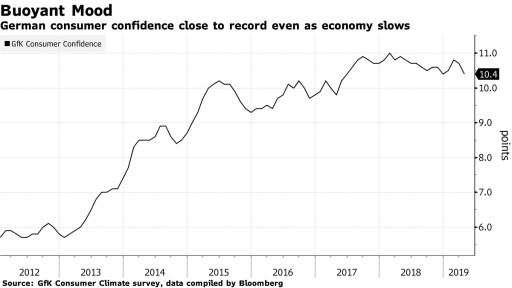

Chancellor Angela Merkel's government feels that the German economy is in trouble, but voters do not see the coming storm for the moment.

This creates a conundrum for German officials how to deal with the risks without losing investor confidence until Merkel has entered the last years of his political career. While the government envisages only a short delay before the growth is recovered next year, the body language of officials suggests that they are preparing for potentially much more severe outcomes.

Leaders who are preparing to assume when Merkel retires are also worried. They say voters can be caught unexpectedly by an economic shock in the middle of the political transition. Two senior party officials this month expressed concern that such a double blow could shake the political map before the next election.

The clearest sign of government concerns is his plan to stabilize Deutsche Bank AG by merging with local competitor Commerzbank AG. The fact that ministers are ready to take the political blow of about 30,000 redundancies shows how seriously they are taking the threat of recession, exposing the leading creditor to the country of a bailout plan.

MPs in the ruling coalition also discuss whether they should loosen the constitutional constraints on deficit spending. This suggests that they also predict a more serious drop in profits and a contraction in growth.

"There are currently many global risks to the economy," said Matthias Heider, a member of the Merkel party and a member of the Economic Committee in the lower house of parliament. "If global risks accumulate, growth may be hard to keep stable at current levels."

Merkel cautiously avoids raising concerns, although Brexit, China's slowdown and US trade strain are Germany's. In an address to the Bundestag last week, she told MPs that she foresaw "growth times," while the prospects for the European Union were "somewhat obscure."

Finance Minister Olaf Scholz commented that he is ready to use all the fiscal freedom he has to stimulate the economy if the crisis strikes, even though he has ruled out the possibility of changing the rules to provide more ammunition.

Source: Bloomberg Finance L.P.

Chart: Used with permission from Bloomberg Finance L.P.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.