- Home

- >

- Daily Accents

- >

- “Get ready for the FED” – a short guide to the trader

"Get ready for the FED" - a short guide to the trader

Investors are dazzled after one of the worst years in the history of financial markets, and before them is the last hope for a "rescue belt": the Federal Reserve.

Chances remain high that Jerome Powell will announce a raise of the base rate by 0.25 basis points on Wednesday, but rather what comes after lifting, holds Wall Street on nails.

"The FED is really pressed in the corner because of all the noise that rises in the markets so what should or should not take as moves and what they have to do." - says Terri Spath, Portfolio Manager at Sierra Mutual Funds.

Will we have a dovish hike to signal a slowdown in their future interest rate rises? Will it remove the phrase "future gradual lifting", indicating a direct pause? Will Powell respond to the White House political tension?

FEDs start running on the knife blade, and investors are getting ready to answer them.

EQUITIES

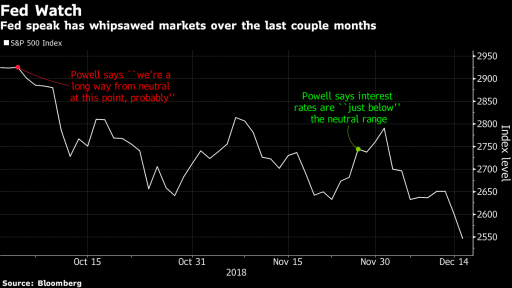

Perhaps the FED is in its most difficult period of investor relations. The S & P500 has fallen more than 10 percent since the last FED meeting, closing at its lowest level for the year on Monday, a weakness that is rarely seen before the baseline interest rate.

An dovish FED, which shows signs of deterring its current monetary policy and returning to economic data, will have to go a long way until it completely suppresses concerns that the Central Bank will engage the economy in recession because of its tightening policy. But an excessively dovish FED can change the meaning of "economic slowdown" so as to scare investors and trigger a new strong bear market. The only thing we know is that investors will become suspicious if the FED opt out of the move to gradually raise interest rates because it may indicate that the Central Bank is worried about the prospects for the economy.

BONDS

Bond traders will focus on the new dot plan, which indicates expectations for future interest rates. Economists forecast three rises for next year, which became clear from their meeting in September. In the bond market, we saw a strong "revaluation" since then, which led to an inversion in the yield curve for the first time in a decade.

Here too, traders want a clear explanation - dovish explanation, but not too pessimistic. For Societe Generale, this means lowering the expectations for interest rates in 2019 from three to two. As long as this expectation is argued, it will be quite dramatic. Such a change in the dot plan will bring the 10-year bonds below 2.75%.

FOREX

The booming expectations for dovish FED would be in favor of the dollar - the bulls. Even with the US Dollar approaching the 2018 tops, the bears have little expectation of a strong boost to the dollar after the decision on Wednesday. It will be difficult to push the dollar over the peaks and thus beat the expectations of the market. To do this, a real FED should not raise interest rates tomorrow. The mood in the dollar is more likely to grow than to weaken, considering how much the dovish market moods are.

It seems that hedge funds and speculators agree with this statement. According to the latest CFTC report, bullish attitudes are close to the tops of 2017.

There is also the expected FED to take a more cautious move and reduce its forecast for two interest rates in 2019 instead of three. "Green money" could make a huge leap against the euro as economic data from the US and Europe start to diverge. The dollar is up about 5% this year against the euro.

EMERGING MARKETS

Any signal from the FED that they are willing to slow down will be the best option for the EM markets that entered the "hole hole" in October.

Goldman Sachs believes that the Fed's delay will have a positive impact on emerging market shares next year, and the likelihood of the Central Bank rethinking its policy has already prompted many investors and traders to re-examine the different asset classes in EM.

Expectations are that these markets will start very rally, given that currently the shares and indices from developing countries are at attractive prices.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.