- Home

- >

- Stocks Daily Forecasts

- >

- Get ready for the market’s August surprise

Get ready for the market’s August surprise

The U.S. stock market in July lived up to historical norms; will it do so in August too? We should only be so lucky.

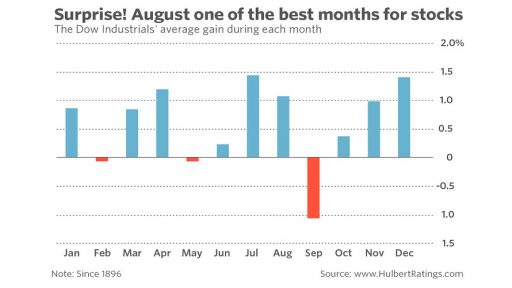

I say that because July is one of the best months of the calendar for the stock market, on average, and August is close behind. In fact, as judged by the Dow Jones Industrial Average DJIA since its creation in 1896, the July-August period is the best two-month stretch of the calendar.

Sure enough, the Dow in July produced stellar results—up 2.5%. Now it’s August’s turn.

It’s important to point this out because most investors think the best they can do during the summer is not lose money. After all, those months come right in the middle of the six-month seasonally unfavorable period on Wall Street. So investors are surprised to learn that July and August are some of the strongest months of the year for the stock market.

The data don’t lie. As you can see from the above chart, the Dow’s average July performance is a gain of 1.4%, plus another 1.1% during August. The Dow’s average gain during the other 10 months of the calendar is just 0.5%. This difference between the average July-August gain and that of the other months is significant at the 95% confidence level.

Given this, you might wonder why anyone in the first place considered the summer to be a seasonally unfavorable period. My hunch is that a big reason is simply the awkwardness involved in reporting the seasonal tendencies in a more nuanced fashion. As you can see from the accompanying chart, the May-June period has exhibited below-average returns, as has the September-October period.

In essence, July and August suffer from being sandwiched between seasonally weak two-month periods. Try to reflect that reality with as catchy a headline as “Sell In May and Go Away.”

Another reason why many investors may overlook July-August strength is that they focus on too little of history. Since 1972, believe it or not, the stock market in these two summer months has been a below-average performer — the opposite of the pattern seen prior to then.

To be sure, July-August strength prior to 1972 was so pronounced that, even after taking the years since then into account, the pattern still exists. So the post-1972 experience is not enough, in and of itself, to conclude that the longer-term pattern no longer exists.

Source: Bloomberg Pro Terminal

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.