- Home

- >

- FX Daily Forecasts

- >

- Global stock market sell-off won’t stop the Fed from hiking interest rates

Global stock market sell-off won't stop the Fed from hiking interest rates

A recent global stock market sell-off won't be enough to persuade the U.S. central bank to stop raising interest rates, noted economist Mohamed El-Erian told CNBC on Friday.

It comes as financial markets have been hit hard by a range of worries in recent weeks, including the U.S.-China trade war, a rout in emerging market currencies, rising borrowing costs and bond yields and economic concerns in Italy.

"I don't think the party is over. I think what we are seeing is a transition in regimes," El-Erian, chief economic advisor at Allianz, told CNBC's Hadley Gamble in Paris on Friday.

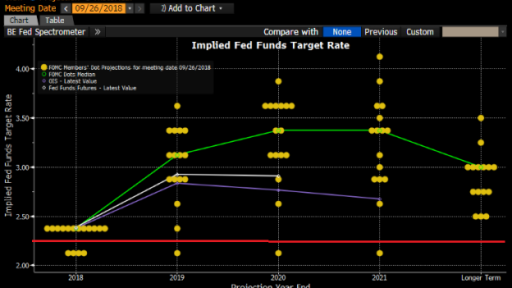

The Federal Reserve has already hiked rates three times this year, and investors have priced in a fourth hike in December.

Earlier this month, Fed Chair Jerome Powell said rates are a long way from so-called neutral, a level neither accommodative nor restrictive to the economy.

Since beginning his four-year term at the Fed in February, Powell's tenure has been marred by disapproving comments from President Donald Trump.

At the start of the month, Trump called the Fed's plan to continue hiking interest rates "crazy" after the S&P and the Dow marked their worst losses in eight months. Global markets have since whipsawed in recent weeks, amid lingering worries the Fed could soon pick up the pace of its planned interest rate hikes.

Nonetheless, El-Erian said it was "not surprising" to see a recent spike in market volatility. That's because the Fed has been "very insistent" with its plan to raise interest rates this year and next — without saying "a single soothing word" during the recent bout of selling.

Source: CNBC

Chart: Used with permission of Bloomberg Finance L.P.

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.