- Home

- >

- Daily Accents

- >

- Gold and the yen rising, as oil marks new bottomс – market wrap

Gold and the yen rising, as oil marks new bottomс - market wrap

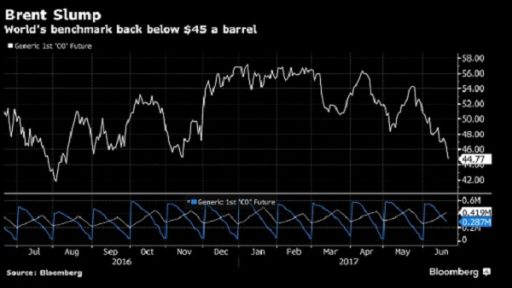

West Texas Intermediate crude fluctuated amid speculation that rising U.S. output will blunt OPEC-led efforts to trim a global glut. Technology companies continued to recover from a selloff, lifting Asian equities. Australian shares bounced back after the biggest drop since November, while Chinese stocks climbed for a second day after MSCI Inc.’s decision to include mainland shares in its indexes. The kiwi rose after the nation’s central bank maintained its neutral policy stance.

The oil rout is raising the chance that inflation will be harder to come by, adding to concerns at the world’s most influential central banks. The weakness in crude and other commodities dents arguments from U.S. Federal Reserve officials that weak inflation rates will be transitory, even as the economy shows few signs of distress. More reaction from central bank policy makers may come from Jerome Powell, James Bullard and Loretta Mester who are all due to speak this week.

Stocks

- The MSCI Asia Pacific Index rose 0.6 percent, led by financial and technology shares.

- Australia’s S&P/ASX 200 Index jumped 1 percent, after tumbling

1.6 percent on Wednesday to erase its gain for the year.

- Japan’s Topix added 0.2 percent. South Korea’s Kospi index climbed 0.3 percent.

- Hong Kong’s Hang Seng increased 0.6 percent, while the Shanghai Composite Index advanced 0.8 percent. The CSI 300 Index, which includes A-shares slated for inclusion in MSCI indexes, jumped 1 percent after a similar move Wednesday sent it to the highest close since December 2015.

- Futures on the S&P 500 Index were little changed. The underlying gauge fell 0.1 percent on Wednesday, with Exxon Mobil Corp. and Chevron Corp. contributing the most to the decline.

- The Nasdaq 100 Index climbed 1 percent, continuing its rebound from a two-week selloff. It’s still 1.8 percent away from its June 8 high.

Currencies

- The yen climbed 0.2 percent to 111.12, strengthening for a third day. The kiwi rose 0.3 percent to 72.49 U.S. cents. Read more on the central bank decision here.

- The Bloomberg Dollar Spot Index fell 0.1 percent. The South Korean won, Mexican peso and South African rand each rose at least 0.2 percent.

- The pound was flat after jumping 0.3 percent on Wednesday.

Bank of England chief economist Andy Haldane said that the risks of leaving policy tightening too late are rising, contrasting sharply with the tone set by the bank’s Governor Mark Carney just the day before.

Bonds

- The yield on 10-year Treasuries fell one basis point to 2.15 percent.

- Yields on Australian government bonds with a similar maturity dropped one basis point to 2.38 percent.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.