- Home

- >

- Commodities Daily Forecasts

- >

- Gold could sink to $800: Yamada

Gold could sink to $800: Yamada

Gold just can't get a bid.

The precious metal fell near 5½-year lows on Thursday after the second-quarter GDP number showed the U.S. economy is growing at a steady rate and comments from Fed Chair Janet Yellen on Wednesday pointed to the notion of a September rate hike.

Gold is now down 13 out of the past 15 trading sessions, and according to one highly regarded technician, it's about to get even worse.

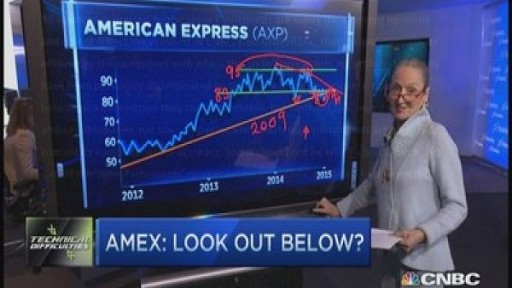

"I think we have to recognize that gold is in a structural bear market," Louise Yamada, managing director of Louise Yamada Technical Advisors, said Thursday on CNBC's "Futures Now."

Gold is down more than 8 percent this year and is on track to notch its third straight year of losses. "It broke down in 2013, exactly the year that the S&P 500 and the market broke out into what we define as a structural bull market," said Yamada, who noted that stocks and gold tend to move inversely.

But it's a descending triangle that has formed on the chart that has her most concerned. Technicians often recognize these patterns as a bearish sign that downside momentum is increasing. "The measured move from $1,400 at the back end of the triangle to $1,200 which was support has now been broken," she said. For Yamada, those moves suggest the next target on the chart is $1,000. "I think that will happen this year."

For Yamada, a move below $1,000 in the next couple of years could open up the floodgates to the 2001 uptrend line. "I think you could see a return to $800," she said.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.