- Home

- >

- Commodities Daily Forecasts

- >

- Gold has ‘unlimited upside’ because the Fed is ‘confused’ on policy

Gold has 'unlimited upside' because the Fed is 'confused' on policy

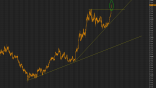

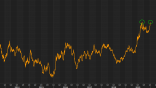

Gold just posted its longest weekly winning streak since July 2011, but if investors missed out on the recent rally, fear not. One trader says the commodity has "unlimited upside," and investors have the Federal Reserve to thank for it.

Tom Colvin said that gold will remain in a bull market that will only come to an end "when central banks take their hands out of the cookie jar." The Federal Reserve is unlikely to hike rates in the foreseeable future, despite a blockbuster June employment report on Friday.

"The year-to-date rally in gold has been nothing short of spectacular, benefiting from what we have seen as a 'confused Fed' or a Fed lacking action," the senior vice president of global institutional sales at Ambrosino Brothers explained.

Gold prices have rallied 28 percent in 2016, hitting a two year high earlier this week. Even as the yellow metal has pulled back from those highs in the last two sessions, Colvin expects these dips to arise as buying opportunities for investors.

Gold started the year in a rally "and it hasn't looked back," Colvin said. "While the first six weeks of 2016 were slow to develop, the Fed's inability to secure more rate hikes, or even convince the market they were coming , fueled the rally we are seeing," he added.

This week, Bank of America-Merrill Lynch forecast that gold was building up a full head of steam that could take it to $1,500 per ounce. Colvin also has bullish expectations for bullion. His near-term target for the precious metal is $1,400, roughly $50 above where it's currently trading. Gold has not been above that level in three years.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.