- Home

- >

- Commodities Daily Forecasts

- >

- Gold isn’t behaving the way it should in theory

Gold isn't behaving the way it should in theory

What works for gold in practice rarely works in theory.

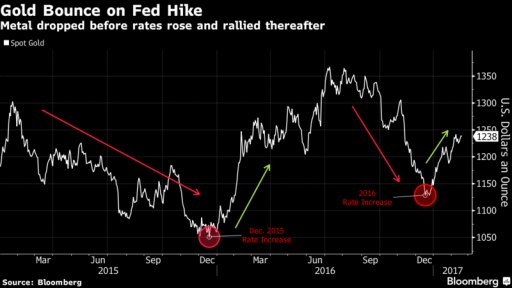

The last three U.S. interest-rate increases that should, all other things being equal, be bad for the metal have seen prices jump in the months that followed.

Gold is up about 7 percent since the Federal Reserve raised rates on Dec. 14. It jumped 13 percent in the two months following the last increase in December 2015 and 6 percent the previous time way back in June 2006.

Partly, it’s rational expectations, and other things getting in the way. This time one of those things is Donald Trump’s presidency. Uncertainties surrounding his administration have dominated markets since the Nov. 8 election.

Precious metals initially plunged as investors noted Trump’s vow to supercharge the economy with infrastructure spending. That would raise returns on assets such as shares and curb interest in havens like gold.

Yet, with Trump’s time in office so far focused on other matters, the trend was quickly halted and reversed. The Fed’s rate increase in December once again became a low-water mark for gold, and expectations for further increases by the bank have failed to halt further price gains.

Investors in the largest exchange-traded fund backed by gold have bought more than 40 metric tons this month, helping to boost prices 6.8 percent this year to $1,236.86 an ounce. There were seasonal gains in the run up to Lunar New Year in January when the Chinese typically purchase gold as gifts.

There are other reasons to seek a haven from political uncertainties. Elections in Germany and the Netherlands are looming, while Britain has yet to agree the terms of its departure from the European Union.

In France, National Front leader Marine Le Pen suggested she’ll take back control of the central bank and print money to finance welfare as she leads France out of the euro, assuming she wins the nation’s presidential election.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.