- Home

- >

- Commodities Daily Forecasts

- >

- Gold prices edge down as dollar stays firm ahead of U.S. Fed meeting

Gold prices edge down as dollar stays firm ahead of U.S. Fed meeting

Gold prices extended losses into a fourth session on Monday, with the dollar remaining supported as investors expect the U.S. Federal Reserve to raise interest rates this week.

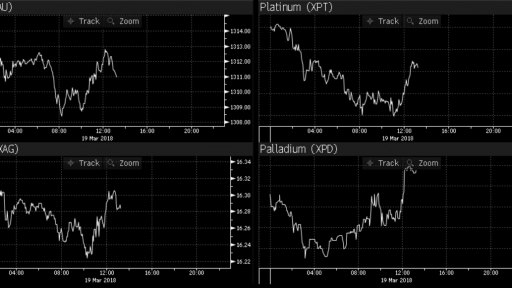

Spot gold was down 0.1 percent at $1,311.70 per ounce at 0402 GMT, after falling 0.8 percent last week.

U.S. gold futures for April delivery dropped 0.1 percent to $1,311.60 per ounce.

"I think the overall economic recovery is good enough for the (U.S.) central bank to consider a faster pace of normalization of monetary policies," said Mark To, head of research at Hong Kong's Wing Fung Financial Group.

A two-day Federal Open Market Committee (FOMC) meeting begins on Tuesday, with the U.S. central bank expected to hike interest rates for the first time this year.

"It is somehow expected and is already priced in the market so I stick to my prediction that precious metals, with gold included, are going to have range-bound trading, unless something really surprising happens," said To.

With a 25 basis point rate hike seen as a done deal, one key focus is on whether Fed policy makers forecast four rate hikes this year instead of the three they had projected at December meeting.

Gold is highly sensitive to rising U.S. interest rates, becoming less attractive to investors as it does not bear interest.

The dollar held steady against a basket of major peers on Monday as traders braced for the Fed meeting and as the increased threat of trade protectionism kept markets on edge.

The dollar index was up 0.1 percent at 90.283. On Friday, it hit a two-week high near 90.38, following strong U.S. economic data.

"Potential market headwinds from the underlying (susceptibility) to risk-appetite, heightened (geo)political tensions, inflation concerns, Russia tensions, to name a few, could help keep the floor on gold prices in check," Stephen Innes, APAC trading head at OANDA, said in a note.

Gold speculators cut their net long position by 16,153 contracts to 145,659 contracts, according to the U.S. Commodity Futures Trading Commission (CFTC) data. This was the smallest net long position since early January.

Among other precious metals, silver was down 0.1 percent at $16.29 per ounce and palladium fell 0.4 percent to $990.90 per ounce.

Platinum rose 0.1 percent to $944.10 per ounce after touching its lowest since Jan. 3 at $939.50.

Bloomberg Pro Terminal

Trader Velizar Mitov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.