- Home

- >

- Commodities Daily Forecasts

- >

- GOLD: Where will be the next big move?

GOLD: Where will be the next big move?

The main reason why investors are so interested in gold and USD is related to their perceived inverse correlation. We say "perceived" because the reverse correlation is only for a very long time. In the short term, however, the two assets are not strongly connected.

Gold and USD will start a new bullish or bearish trends

The long-term outlook of USD is bullish at this point based on the long-term trend. Furthermore, there is a key level around 101 and once the dollar breaks above it and hold three consecutive weeks, this will be a strong bullish signal.

In the short term the uptrend movement is also confirmed that lead us to the conclusion that the rise in price is much more likely because the confirmation of short-term and long-term trends. As shown below, the USD becomes strong bullish above 101 and below 98.50 is bearish in a short to medium terms. A break below 90 would signal for a long-term downtrend.

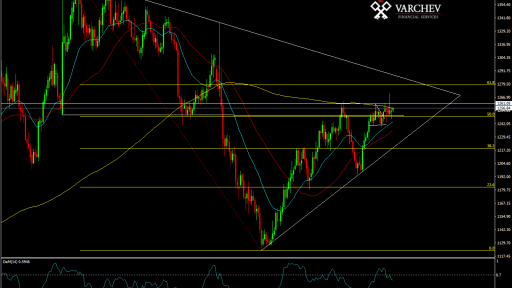

Gold is also in a "neutral" zone, though it is close to starting a new trend. Although the model of the triangle is different than the USD, this leads to the same conclusion. Will be formed a short and medium uptrend when the price move above $1290. While under $1220 will signal for a downtrend.

In the long term movement of gold remains downward until break above $1350.

SPDR Gold Trust ETF (NYSE:GLD) for a period of one year has increased by 8.99% against 5.22% in the S&P500 over the same period. GLD is currently evaluated as grade "B" (Buy) and is rated at #6 of 33 ETFs in the categories of precious metals ETFs.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.