- Home

- >

- Daily Accents

- >

- Golden Fever in Straight Path Communications inc. bidding

Golden Fever in Straight Path Communications inc. bidding

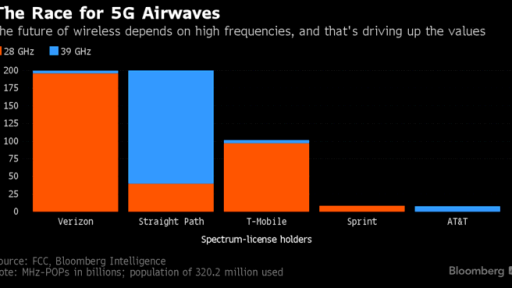

The bidding war between AT&T Inc. and a company said to be Verizon Communications Inc. for 5G airwave-

license holder Straight Path Communications Inc. has reached a fever pitch.

After weeks of offers and counter-proposals, the standing offer for the company is now $3.1 billion, or $184 a share almost double what AT&T offered last month.

The latest bid by the “multi-national telecommunications company” said to be Verizon sent the shares of Straight Path soaring to $220.86, a new high. With no end in sight, investors are betting the tug of war between two telecom giants will only continue to drive up the value of Straight Path’s spectrum

licenses.

The competition for Straight Path underscores the importance of 5G to AT&T and Verizon’s futures. Straight Path is one of the largest holders of spectrum approved for fifth- generation use, and AT&T and Verizon are both eager to use those airwaves to build the nation’s leading 5G network, helping

relieve congestion on older networks and court new customers looking for lightning-fast internet.

With 5G, AT&T and Verizon can offer blazing-fast internet speeds competitive with cable-TV operators while relieving congestion created by consumers who demand Netflix video and live sports streamed directly to their devices. But 5G needs spectrum - the invisible delivery system for all that data.

As Straight Path growth is over, and we can focus on AT&T and Verizon. Depending on which of the two companies is able to buy Straight Path, we can expect a serious increase in stock prices, as this technology will be able to change the Internet and the world.

Source: Bloomberg

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.