- Home

- >

- Daily Accents

- >

- Goldman: Hedge funds in shares with the biggest losses

Goldman: Hedge funds in shares with the biggest losses

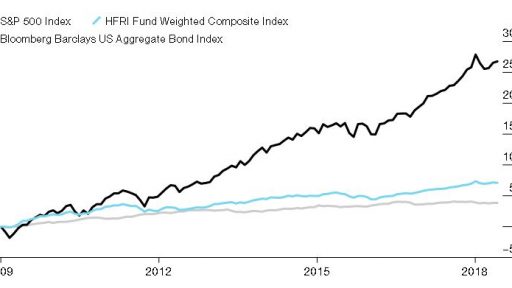

It is well known that hedge funds do well when the market is stressed, but many do not do well as the sale started this month.

This week, funds that took positions against and together with the market had one of their worst days in seven years, which is reflected in a recent report by Goldman Sachs Group Inc. Goldman reported a decline of 1.44% for short-term funds, a decline that occurred on Wednesday, and this is the strongest fall in one day since the bank began tracking the data coming out of the January 2012 funds. Funds for the month of October are down 8.68%, which in terms of yield is negative by 6.21% since the beginning of this year. The S & P500 has lost 8.8% of its value for this month and 0.65% for the year. The Nasdaq Composite Index is down 12% this month. Namely, technology stocks have been selected by hedge funds this year.

Funds with a fund for long and short positions are the worst performers, but there are some who behave better, even if they lose money. T. systematic hedge funds that use algo trading, which pick shares are down 3.72% since the beginning of the year. In October, they reported a decline of 1%.

Source information: The Wall Street Journal

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.