- Home

- >

- Stocks Daily Forecasts

- >

- Goldman Sachs just shattered a myth about how higher rates affect stocks

Goldman Sachs just shattered a myth about how higher rates affect stocks

It's conventional wisdom that when interest rates rise, investors should steer clear of stocks with high dividend yields.

The logic is simple: Rising rates make the yields offered by equities less attractive by comparison, and since those stocks rely so heavily on their appeal as so-called yield proxies, any competition can lead to selling.

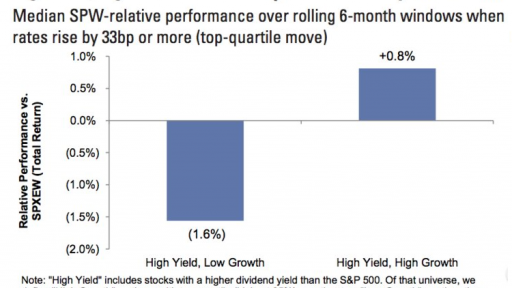

While Goldman Sachs acknowledges that this dynamic is true to a degree, it argues that stock gains can still be found among high-dividend payers — as long as investors know where to look. To Goldman, the key is not how much these stocks are paying in dividends, but how quickly they're growing that yield. By its measure, the top 25% of dividend-growers in the S&P 500 have outperformed during past rising-rate environments.

"With the spectre of rising rates, we expect that dividend growth stocks will be relatively more immune," Jessica Binder Graham, an analyst at Goldman, wrote in a note to clients. "We find that the high dividend growth stocks not only outperform high yield, low growth stocks during rising rate environments... but also continue to outperform the broader index."

It's an important discussion to be having right now, considering the Federal Reserve is expected to raise interest rates three times this year, with more-hawkish commentators calling for four hikes. In a written testimony released Tuesday morning, the Fed's chairman, Jerome Powell, did nothing to shift these expectations.

"Some of the headwinds the US economy faced in previous years have turned into tailwinds," Powell said. "Fiscal policy has become more stimulative, and foreign demand for US exports is on a firmer trajectory."

As income investors — traders who seek yields such as those provided by dividends — await further signals from Powell and the Fed, they can rest easy knowing there's at least one segment of their universe that should stand tall as rates rise.

Source: Goldman Sachs

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.