- Home

- >

- Daily Accents

- >

- Goldman Sachs: The future of the bull market hinges on one key driver

Goldman Sachs: The future of the bull market hinges on one key driver

Profit growth — the primary driver of the 8-1/2-year stock bull market — may soon be slowing. That means something else will have to step up and take its place if the rally is to continue.

Goldman Sachs thinks the most likely solution comes from further up on the corporate-income statement, in the form of revenue expansion.

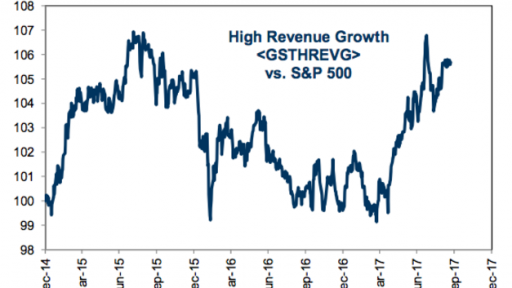

In fact, companies showcasing the highest sales growth have already started proving themselves this year. A Goldman basket of high-revenue stocks has outperformed the benchmark S&P 500 by 7.3 percentage points this year, according to data compiled by the firm.

To understand why the suggested shift is necessary to keep the bull market afloat, it first helps to understand the outsize role that earnings growth has played in the third-longest period of equity expansion on record.

Since the start of the period in March 2009, higher profits have contributed 61% to the S&P 500's 270% gain, Goldman says. Of that, the firm estimates that roughly half stems from margin expansion. With higher labor costs and interest rates on the horizon, Goldman forecasts that further profit-margin growth will take a hit.

This is not to say the S&P 500 will continue to climb unabated. Because of the headwinds outlined above, Goldman sees the benchmark declining 100 points — or roughly 4% — to 2,400 by the end of the year.

Only after that will the S&P 500 continue to grind higher over the course of the subsequent two years, according to the firm. It assigns a 2018 year-end price target of 2,500, largely unchanged from current levels, before the index rises climbs to 2,600 by the end of 2019.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.