- Home

- >

- Stocks Daily Forecasts

- >

- Hedge Funds’ #1 Stock Picks in Real Estate, Airlines & More

Hedge Funds’ #1 Stock Picks in Real Estate, Airlines & More

Let's look at the hottest stocks among the hedge funds that made their 13F report on June 30.

Hedge Funds’ #1 Automotive Stock Pick: General Motors Company (NYSE:GM)

Number of Hedge Fund Shareholders of GM (as of June 30): 59

Value of Hedge Funds’ Holdings in GM (as of June 30): $6.19 billion

General Motors Company (NYSE:GM) is the top auto stock among hedge funds, with 59 owning it on June 30, down slightly from 64 on March 31. That placed GM far ahead of rival Ford Motor Company (NYSE:F), which was the next most popular auto stock with just 32 hedge fund shareholders. Warren Buffett‘s Berkshire Hathaway is one of the biggest GM bulls, owning a position of 51.39 million GM shares worth over $2 billion.

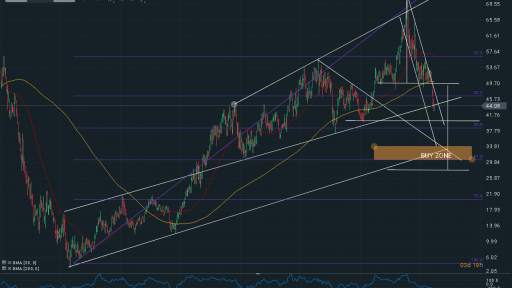

The company's problems in 2018 hit another big GM bull, billionaire David Einhorn from Greenlight Capital. His fund lost an astounding 25.7% this year, mirroring GM's loss, accounting for over 26% of Greenlight's portfolio at the end of Q2. The price is currently in diagonal support on a weekly schedule, with preconditions for a double bottom. Upon closing a bullish bar above 50% Fibonacci, measured from bottom 22.07.2007 to the peak of October 15, 2017, positive technical expectations and new purchases to support the price may accumulate.

Hedge Funds’ #1 Airline Stock Pick: Delta Air Lines, Inc. (NYSE:DAL)

Number of Hedge Fund Shareholders of DAL (as of June 30): 66

Value of Hedge Funds’ Holdings in DAL (as of June 30): $6.50 billion

Delta Air Lines, Inc. (NYSE:DAL) is the most popular airline stock, being owned by 66 hedge funds on June 30, down from 73 at the end of March. United Continental Holdings Inc (NASDAQ:UAL) ranked second, being owned by 42 shareholders. Wayne Cooperman‘s Cobalt Capital Management raised its Delta Air Lines position by 136% to 502,862 shares as of June 30.

Delta Air Lines, Inc. (NYSE:DAL) recently hiked its baggage fees by 20% to $30 per bag, part of a broader industry initiative to offset rising fuel prices. Fears that Congress would implement a mandate targeting the fair usage of such fees were relieved last month, when plans to do so were dropped. That puts Delta in a position to capitalize on strong traffic and capacity trends in the industry going forward. Delta Air Lines, Inc. (NYSE:DAL)’s traffic and capacity have each risen by at least 3.5% in each of the past three months.

Hedge Funds’ #1 Real Estate Stock Pick: Lennar Corporation (NYSE:LEN)

Number of Hedge Fund Shareholders of LEN (as of June 30): 63

Value of Hedge Funds’ Holdings in LEN (as of June 30): $3.76 billion

Lennar Corporation (NYSE:LEN) is hedge funds’ favorite real estate stock, being owned by 63 of the investment firms tracked in our database as of June 30. That easily toppled the closest rival D.R Horton (DHI), which was owned by 36 hedge funds on the same date. Matthew Knauer and Mina Faltas’ Nokota Management opened a new position in Lennar during the second quarter, which contained 272,475 shares at the end of the quarter.

Shares of homebuilders have slumped in 2018 and Lennar Corporation (NYSE:LEN)’s shares have been no exception, falling by over 33% this year. Despite a hot economy, the housing market has cooled off considerably of late, with monthly sales falling on a year-over-year basis in each of the past six months as rising mortgage rates and homebuilding costs have tempered consumer enthusiasm for home ownership. Lennar Corporation (NYSE:LEN) is discussing the sale of its real estate lending unit Rialto Capital with private equity firm Stone Point Capital, in an effort to bolster its core business. Although the main move for the moment is retained on a weekly schedule, we notice an upside-down head-to-shoulder formation with weaves, and we have samples of the line. The formation zone is about $ 30, where combined with the diagonal trendline and 61.8% Fibonacci can take a long position.

Source: Insider Monkey

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.