- Home

- >

- Daily Accents

- >

- Hedge funds are back in the game

Hedge funds are back in the game

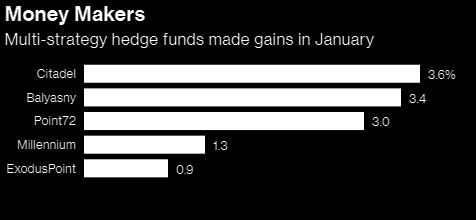

Ken Griffin's Citadel Fund and Steve Cohen's Point72 Asset Management increased in the past month after hedge funds with combined strategies capitalized rebounds in the stock market.

Wellington Hedge to Citadel has risen by 3.6% and Point27 by 3%, say people familiar with the case. Dimitry Balyasny's Balyasny Asset Management posted a 3.4 percent increase in its Atlas Enhanced Fund, booming after nearly 20 percent in 2018 by nearly 7.1 percent.

Combined strategies funds invest in mixed classes of assets from company shares to bonds and currencies, as well as interest-driven derivatives. The funds have benefited from the rise in indices and stocks. The S & P500 index rose by 7.9% and the Bloomberg Barclays global bond index by 1.5%.

Several other large funds have lagged behind their competitors. Michael Gelband's ExodusPoint Capital Management, which last year made a profit of $ 8 billion, has now grown by only 0.9%. Izzy Englander's Millennium Management, which manages $ 35 billion, posted a 1.3% return over the past month.

Cidatel, which manages more than $ 28 billion, has earned shares, fixed income assets and raw materials. Global Equities rose 1.5% in January, and Tactical Trading Fund and Global Fixed Income Fund posted a 2.7% rise.

Balyasny continues to run out of cash, with the fund starting at about $ 7 billion this year, compared with $ 11.3 billion in start-up capital in 2018.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.