- Home

- >

- FX Daily Forecasts

- >

- Hedge funds are ditching the old school FX strategies

Hedge funds are ditching the old school FX strategies

Forex traders are gradually changing their trading strategies after the most time-tested strategies cracked this year.

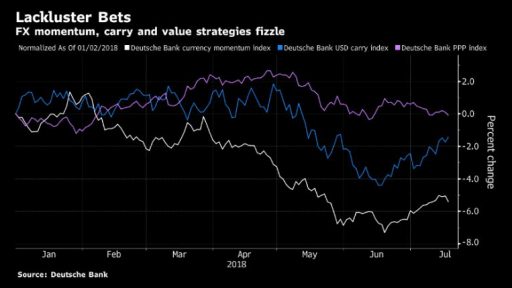

Momentum, carry and value bets have delivered lackluster returns in foreign exchange this year, prompting some money managers to shelve them in favor of event-driven and niche positions.

Maybe only carry trades on EURUSD and USDJPY, where a strong dollar brace brings profit from the central bank's interest rate differential. But considering the bearish sentiment against USD after dropping by 8.5% in 2017 and the sharp turnaround in sentiment this year's may have led to confusion among portfolio managers and low returns on the FX market for the first half of 2018.

Momentum strategies are down 5% this year after falling by 2% in 2017, according to the index of Deutsche Bank AG. Carry trading, where investors take up where interest rates are low and invest revenues where yields are higher, fell 1.3 percent after a 1 percent loss last year. Value bets are unchanged at a 1% increase in 2017

"Trade has changed to become a little shorter and tactical, with tighter targets / stops," said Brendan Murphy, head of global and multisectoral bonds at Standish, part of BNY Mellon Investment Management in North America. According to him, there has been a larger gap between the hedge funds against the dollar where long-term investors remain short while short-run traders have managed to short squeeze EURUSD.

BNY Mellon Investment Management has taken advantage of the situation by using options that are a cheap way of delivering greater return on the situation since the beginning of the year.

The effectiveness of old-school marketing strategies has seen a loss of 4%, with CFTC showing that the hedge fund has turned its bulls-to-dollar bets against USD in June.

"It is difficult to trade with traditional currency strategies, given the great uncertainty stemming from the rise in populism and trade protectionism," said Sireen Harajli, an external strategist at Mizuho. "The current trade and military environment is unprecedented," and "it has become difficult to predict the market reaction of some events."

Source: Bloomberg Finance L.P.

Chart: Used with permission of Bloomberg Finance L.P.

Trader Nikolay Georgiev

Trader Nikolay Georgiev Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.