- Home

- >

- Daily Accents

- >

- Hedge funds see MiFID win in EU warning to trading platforms

Hedge funds see MiFID win in EU warning to trading platforms

Hedge funds and high-speed traders have been fighting for years to level the playing field with banks on derivatives trading. They just won a round in Europe.

The European Securities and Markets Authority said earlier this month that trading platforms should ensure access to a broad array of firms and warned against discriminatory policies that would favor some traders over others. ESMA published the guidance to help the European Union’s overhaul of trading rules known as MiFID II live up to its promise of making markets more open, competitive and transparent.

Stuart Kaswell, general counsel for the Washington-based Managed Funds Association, said the guidance was a “smart regulatory development” and welcome news to investors.

“ESMA’s decision will help improve transparency, increase liquidity, promote competition and provide greater access to trading platforms for many market participants,” Kaswell said in a statement. The association’s membership includes many of the world’s biggest hedge funds.

The potential for access limits and discriminatory policies has been a key concern for proprietary trading firms, which wager their own funds often by using computerized or high-speed technology, according to Piebe Teeboom, secretary general of the European Principal Traders Association. The guidance “will help ensure that MiFID II succeeds in dismantling existing access barriers, increasing competition and pre-trade transparency for all market participants,” he said.

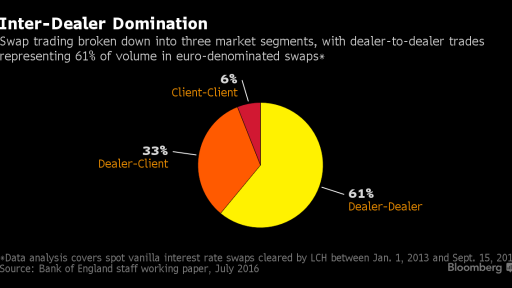

The publication shows that while MiFID II has been years in the making, fine details and rules still being laid out by regulators months before it goes live in January are being watched closely by the industry. These adjustments may go a long way toward determining how much MiFID II will change a market currently dominated by banks.

In its release, ESMA spelled out types of policies that trading platforms shouldn’t have because they would be considered “non-objective and discriminatory” and “place unreasonable restraints” on certain firms’ access to trading.

Reemt Seibel, a spokesman for ESMA, said the guidance was issued “to address potential practices head-on before MiFID II even applies.” The regulator is working out the scope and timing of the rules that require derivatives to be traded on platforms.

The hedge fund and proprietary trading lobbies, alongside others representing traditional buyers of derivatives, already successfully pushed for similar treatment in the U.S. In 2013, the U.S. Commodity Futures Trading Commission, the top swaps cop, told trading platforms not to violate the spirit of open access under the Dodd-Frank Act. The groups continued to push U.S. regulators to pursue additional policies to open access.

Christophe Roupie, head Europe and Asia at MarketAxess Holdings Inc., said the platform operator decided in 2015 to give traders more choice about how to execute transactions by lifting a restriction on the number of counterparties that can be put in competition for prices for European products.

The ESMA guidance “should be taken very seriously,” Roupie said by email. “I would certainly expect the industry to make every attempt to make the necessary adjustments to their trading models ahead of MiFID II.”

Source: Bloomberg

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.