- Home

- >

- Commodities Daily Forecasts

- >

- Hedge funds with record bet on oil growth. Where to expect a twist?

Hedge funds with record bet on oil growth. Where to expect a twist?

Despite all the noise that the United States is the new oil market rocker to meet world demand, while OPEC cuts production, oil continues to grow. Brent varied to $70 a barrel, and WTI traded close to $64. How long will this increase last? The higher the prices, the more exporting countries are beginning to discuss reducing the abstraction program for oil.

Goldman Sachs has already warned that OPEC will try to reduce yield when WTI reaches $68- $70 a barrel to limit the cartel's impact on the global economy. on behalf of officials, Russian energy minister Alexander Novak said that oil producers regularly talk about options for terminating the deal for abridged mining. Iranian oil minister Bijan Namdar Zanganeh even admitted that OPEC does not like WTI over $60 due to the growing shale oil exports, which occupies much of the oil market. The statement comes at the same time as the US government predicts a record-breaking yield.

What do the big market players and how do they trade it?

According to RBC Capital Markets and UBS Group, a rise in prices over $ 70 a barrel will be inconsistent with the growth rate of consumption.

Bank Blanc, Chief Executive Officer of Bank Of America Merrill Lynch, said that Brent's prices will stay at the current levels throughout the year, while production and consumption will grow at the same time.

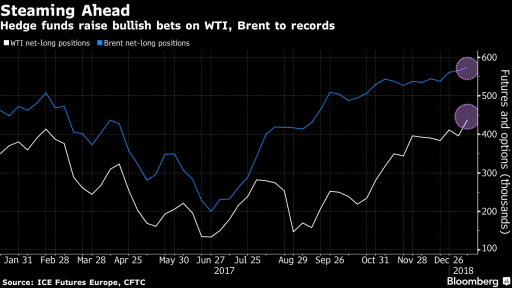

Hedge funds have increased their net exposure to WTI, with the difference between long and short positions according to CFTC amounting to 437,770 contracts, the highest since 2006. here.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Bloomberg: Record Betting on Oil's Rally Begs Question: How Far Can It Go?

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.