- Home

- >

- Stocks Daily Forecasts

- >

- Here are some mind-blowing stats about Apple’s incredible run

Here are some mind-blowing stats about Apple’s incredible run

Apple's run from the bottom to a record-high closing has been nothing short of incredible.

Apple closed on Monday at $133.29 a share, surpassing its record closing high price of $133, set in February 2015.

The stock is up more than 15 percent in 2017, gaining nearly $100 billion in market cap in just six weeks. It's also just points away from a split adjusted price of $1,000 a share.

Perhaps what's even more impressive is the move from its 52-week low in May. The stock has rallied nearly 50 percent and gained more than $200 billion in market cap in just nine months. For context, that market cap gain from the low is larger than the total market cap of 488 companies in the S&P 500, including Visa, Pfizer and Verizon. It's $1 billion less than Wal-Mart, and it's bigger than American Express, Mondelez and Netflix combined.

Even as the stock has come so far, many on Wall Street still consider the tech darling undervalued.

Goldman Sachs also published a note Monday raising its price target on the stock to $150, citing growing confidence in the outlook for the iPhone 8 cycle in the second half of the year.

"I still think there's room to run, and we've seen that with Wall Street analysts. We've seen that target price keep moving up, along with the stock. And so it's still trading about 5 percent below the consensus target price," Erin Gibbs told CNBC's "Trading Nation" on Monday.

"One of the things we're still seeing is really higher expectations for growth for not only this year but for the following fiscal year," said the equity chief investment officer at S&P Global. "There's a lot of positive news about their augmented reality technology, and so I think this is a still a stock to hold."

According to Ari Wald of Oppenheimer, the charts are setting up for an even sweeter rally.

"The charts are bullish. They argue for a sustainable breakout here, and that the stock should be bought," he said Monday on "Trading Nation."

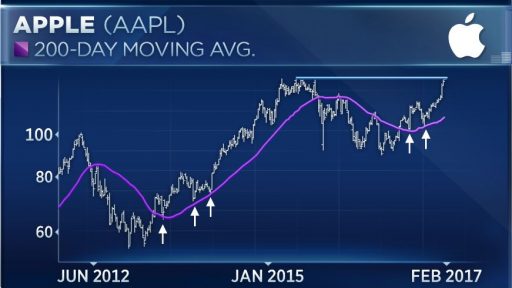

Wald pointed to a rising 200-day moving average and a striking similarity to a previous trend for his bullishness.

"The first thing you'll note is that it has a rising 200-day moving average. So that's indicative of the stock's bullish trend that it's possessed for a couple of months now," he said.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.