- Home

- >

- Daily Accents

- >

- Here is why to look in Europe, when the correction is here

Here is why to look in Europe, when the correction is here

Since equity markets around the world enjoy a fairly good start of the year, market players do not accept European assets such as those in the US and Asia. Still, many of the indicators show that Europe has something to show. The RSI of the Euro Stoxx 50 is still in the range between 50 and 60, pointing upwards and indicating that the rally is yet to come. On the other hand, wage growth rates are lower than other developed and emerging economies around the world. This means that the region may be less vulnerable when it is time for correction.

Manufacturing PMI

After years of crisis in production, the European economy is finally showing signs of steady growth. Germany's and the Eurozone's PMI are at 64 and 61 levels, while the US indicator is struggling with the top of 55.

Investment enthusiasm

Looking at investment enthusiasm, many analysts upgraded European companies' profits expectations to the highest level since June 2017. For comparison, world earnings expectations are at record levels.

P/E

Valuation measures also show a remarkable difference between the inertia of US and European stocks. While the SP500 P/E is above 18 levels (last reached in 2002), the Stoxx 600's P/E moves around 15, away from the peak reached in 2015.

Are the shares in Europe undervalued?

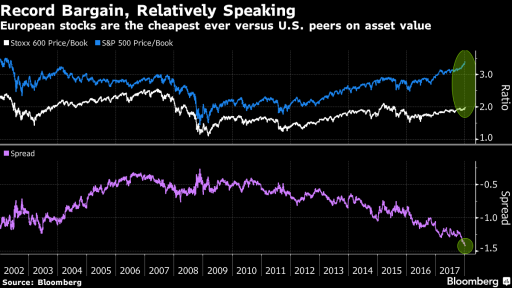

If we take into account one of the most important indicators that tells us whether a share is underestimated, then those in Europe are by no means underestimated - P/B of Stoxx 600 = 2. But in the US, things are even more optimistic , with P/B of SP500 at levels of 3.4.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Bloomberg: Is Europe a Good Place to Hide Stock Market Correction?

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.