- Home

- >

- Cryptocurrencies / Algotrading

- >

- HFT Lose Momentum

HFT Lose Momentum

The most aggressive high-frequency currency traders are showing signs of losing steam, suggesting platforms have succeeded at thwarting some speedy strategies.

Electronic specialists are making waves by eclipsing major banks in foreign-exchange trading. But some strategies -- focused on fast execution and short-term arbitrage -- have reached a “saturation point,” according to the Bank for International Settlements. At the same time, platforms have adopted so-called speed bumps to blunt advantages of the savviest firms, which have been blamed for sniffing out trader intentions to bet against them.

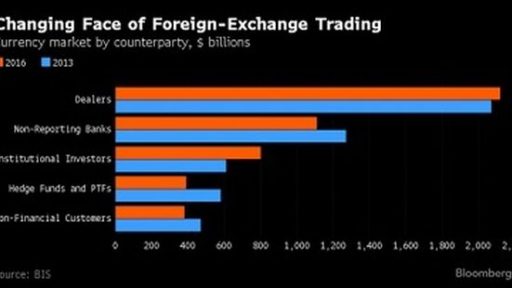

Those factors are behind a drop in buying and selling by hedge-fund and principal-trading firms, which fell to about $390 billion per day from $580 billion three years ago, according to a BIS.

As aggressive strategies wane, firms are increasingly confined to supplying quotes for market making. That’s seen as a passive and potentially more benign style of trading.

Executives at major electronic trading firms say the easy money has already been made. In the U.S. stock market, for example, speed-trader revenue fell to $1.1 billion this year, down from $7.2 billion in 2009.

Principal traders are especially prevalent in spot foreign- exchange, where volume has fallen 19 percent to $1.65 trillion in the past three years. High-frequency strategies are often

used in the spot market because it’s highly standardized, making it better suited to algorithms.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.