- Home

- >

- FX Daily Forecasts

- >

- High interest rates keep the Norwegian krone up

High interest rates keep the Norwegian krone up

The Norwegian krone rises after the central bank decides to raise interest rates by 25 basis points. Nevertheless, Norges Bank also suggested that interest rates remain at current levels in the coming period. In practice, this means that the bank may have already reached its ceiling in terms of monetary tightening against other central banks.

Respectively, the US dollar dropped after the US Federal Reserve decided to cut its base rate by 25 basis points, as expected, but remained deeply divided over the need for further relief as the US economy improves.

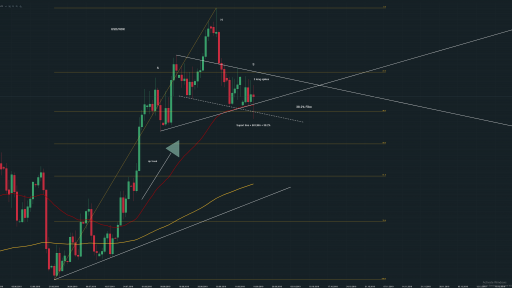

This led to sharp movements in the USD / NOK currency pair, and at this stage these two fundamental news failed to break the range formed between 9.00 and 8.90.

Our expectations: If the price succeeds in breaking the support formed at the 50 period floating average, 382% Fibonacci and diagonal support, then the currency pair will activate the Head-Shoulder formation and could fall by 8.70.

Alternatively, if the price manages to break the 9.00 and 23.6 Fibonacci levels, then it will continue its upward direction at least for the previous peak test at 9.16.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.