- Home

- >

- Daily Accents

- >

- How does the mistery trader “50 cent” trades

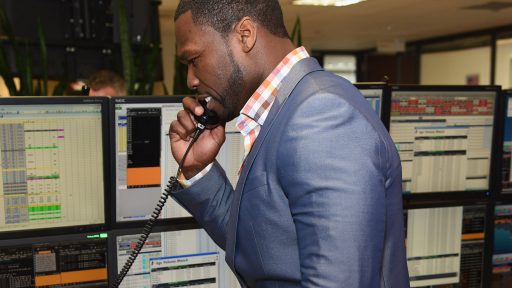

How does the mistery trader "50 cent" trades

For a limited time, you can wager on a stock market selloff for a low, low price.

The trade in question is the purchase of contracts wagering that the CBOE Volatility Index will reach 14 over a 13-day period — in this instance, ahead of May 14 expiration.

The so-called S&P 500 fear index finished last week at 10.82, about 40% below its bull market average, and briefly fell below 10 on Monday.

Such an investment would mirror the efforts of the mystery trader known only as "50 Cent," who earned the nickname by buying gobs of volatility contracts roughly costing that much, set to profit from a spike in the fear gauge.

Also known as the VIX, the index in question is a measure of expected price swings in US equities that serves as a barometer for investor nervousness. It generally climbs as stocks fall, so purchases of VIX contracts translate to bearish wagers on the S&P 500.

"We have seen the VIX jump nearly instantly from extremely low levels to 20-plus," Pravit Chintawongvanich, the head of derivatives strategy at MRA, said in a client note on Monday. "Even a minor disruption to the recent placidity" could make the trade profitable, he wrote.

The fear gauge was locked in a range between 10 and 14 for the first three months of 2017, and while it's since climbed as high as 15.96, it's been stuck well below 14 since a single-day plunge of 26% one week ago.

If you do decide to bet on a near-term VIX spike, 50 Cent would love to join you, except he or she already owns about 450,000 VIX calls expiring in May. As of late last week, the trader is now funneling money into bets set to expire in July and August. After all, volatility prices are collapsing, making longer-dated wagers more appealing.

Източник: Bloomberg

Trader Bozhidar Arabadzhiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.