- Home

- >

- Stocks Daily Forecasts

- >

- How Low Can the FANG Stocks Go? Traders Search for a Bottom

How Low Can the FANG Stocks Go? Traders Search for a Bottom

How long can they go?

This is the key issue Wall Street traders are trying to answer on the biggest tech and internet shares that are among the most dramatic victims after pulling up the indexes for most of the year.

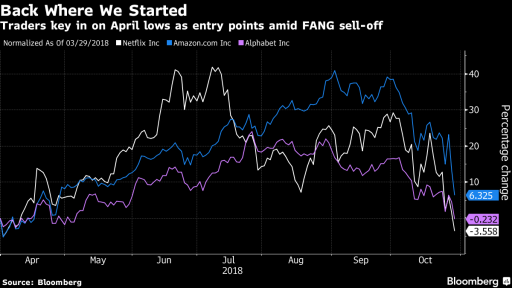

The so-called FANG shares collapsed strongly this month, after the disappointing prospect of global growth, smashed into the dust and dust the thesis that the high values of the shares were supported by the foundation. Amazon.com Inc. and Netflix Inc. saw a particular weakness, with some of the most preferred companies getting an equally aggressive downward move, as the moods that gave them positive bets now work against them.

Other shares of the group, including Facebook Inc. and Alphabet Inc. also saw double-digit declines in recent weeks. This sale is "quite another game," said Bruce Bittles, chief investment strategist at Baird & Co.

"Markets were over-bought on these names, and now there is a release of these positions, just as happened with the marijuana industry," Bittles said, talking about another hot-for-weeks sector. "Now the negative impulse is so strong that it crushes all attempts to raise, people continue to try to determine the bottom and at the same time lose, trying to catch falling knives, but this decline has not yet reached the foundation."

Bitles says he thinks the waves will not turn, before 90% of the trade volume for a single session is not positive. "I look for surrender, then raise."

Amazon dropped 4.1% on Tuesday, the third consecutive downgrade session, even after the wider market rose. The company is still on track to record its worst month since November 2008, and the sale has sent it to the lowest intraday levels since April. At the same time, Netflix fell 4.8 percent, the stock recording its worst month since April 2012.

Michael Matousek, Head Trader, U.S. Global Investors Inc., said investors are now paying a lot of attention to the fund, especially in a precarious environment like the current one, marked by rising interest rates and a potential worsening of the trade war. Amazon and Netflix appear to be too costly compared to traditional valuation methods, one reason why investors started to turn to "old tech" names that have lower growth but also much lower values.

Source: Bloomberg Finance L.P.

Graphics: Used with permission from Bloomberg Finance L.P.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.