- Home

- >

- Fundamental Analysis

- >

- How low interest rates can “freeze” the economy

How low interest rates can "freeze" the economy

Imagine that you own a small restaurant and think about expanding your business. At high interest rates, you will think seriously. When interest falls, you will most likely be more likely to borrow for business growth.

Large chain restaurants, however, are also borrowing low interest rates to take even greater expansion of their business that can steal customers and even close your business.

Over the past two decades or more, this phenomenon has continued to appear in the industries, making the economy as a whole less dynamic. When interest rates fall, big players in an industry can benefit much more from the situation than their smaller competitors. This allows them to grow faster and more productive, but it is also becoming more and more difficult for others to catch up.

Over time, small businesses discourage and stop investing in new products and technologies. And market leaders become so big they are no longer vulnerable to competition. They are also withdrawing from making new investments. The strength of the market is thus concentrated on several large companies and therefore fewer entrepreneurs decide to start a new business.

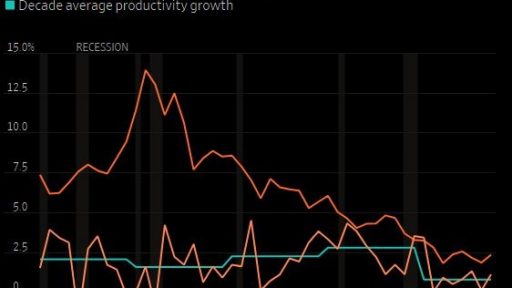

When interest rates begin to fall, market concentration is rising, which reduces productivity and economic growth.

Exploring this phenomenon offers several possible answers to questions that have been harassing economists over the last few years. It helps explain why growth and productivity are on average about 1.3% per year for the past ten years, well below historical levels. And that's the only reason why the economy has been "shut down" ever since the end of the Great Recession, even though the unemployment rate has fallen to its lowest level in 50 years. Also, this may explain why the birth rate in new households has fallen to 10.3% in 2016 from 15.4% in 1987

With the current framework of the economy, it may take nearly 10 years for low interest rates to turn the economy into less dynamic. Indeed, economists find that growth is fasting in the early years before it begins to show signs of slowing down.

This is because, when interest rates start to fall, small businesses start to invest aggressively and invest, trying to catch up with their larger competitors, speeding up productivity and growth.

This happened in 1990. A decline in interest rates, measured by 10-year bonds, has led to large and small businesses investing. Productivity rose on average to 2.2% per year in 1990 and to 2.8% in 2000.

But around 2003, productivity began to slow down, although interest rates also fell. This is the period in which small businesses have begun to catch up with the big players. However, the study of this effect does not answer the question of why interest rates fall gradually. According to other economists, aging populations can lead to a slowdown in the economy and keep interest rates low.

The Federal Reserve and other economists expect the interest rates to remain low for the near future, which means that this economic effect may be coming to an end very soon.

Source: The Wall Street Journal

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.