- Home

- >

- FX Daily Forecasts

- >

- How seasonal patterns did in June

How seasonal patterns did in June

The weak dollar was the main theme of June's seasonal models and was a good move.

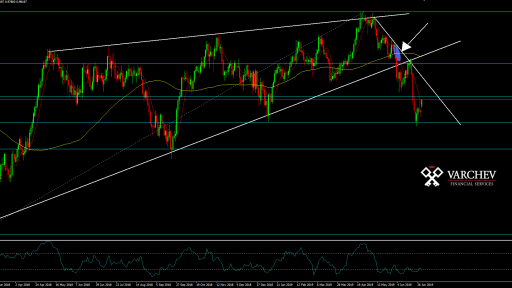

The first highlighted trade earlier this month was a USD / CHF shortcut. The couple dropped 10 out of 12 times in June, and this was the worst month of the calendar. There were also preconditions for a serious breakthrough.

This breakthrough really happened and continued the downward movement, slowing down just below the bottom of the year. The overall move was 2.5%, mainly due to the Fed's position.

The same was true of two other trends - a weakness in EUR / USD and USD / JPY. We noted that June is the second best month for the euro and third for the yen.

The main theme was a weak dollar and he fell against everyone.

Също така отбелязахме и три по-малки тенденции, които останаха със смесени резултати. Нямаше силен сигнал при златото, но месеца се оказа страхотен. Също така имаме и дългосрочен модел за слабост при щатските акции, но и това не се оказа вярно този път. Особено след като Щатските акции записаха най-добрия си месец за последните 50+ години. От друга страна обаче, акциите във Великобритания и Канада се представят слабо през Юни, а сега наистина изпитаха затруднения.

Накрая, NZD/USD и AUD/USD отбелязаха солиден месец, като кивито е особено силно главно заради решението на RBNZ да изчака с решението за лихвите.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.