- Home

- >

- Market Rumours

- >

- If the additional tariffs come into force, a 10% or 15% correction may follow

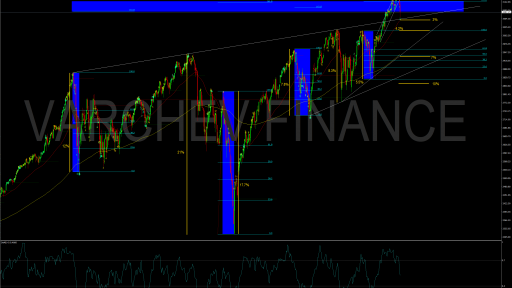

If the additional tariffs come into force, a 10% or 15% correction may follow

President Trump’s comment that he had no deadline on a China deal has predictably thrown markets into a tizzy, as the self-imposed deadline of Dec. 15 for additional tariffs is now less than two weeks away.

The market is now grappling with the likelihood of no trade deal, but the critical issue is tariffs. I asked UBS Art Cashin if traders would be satisfied with 1) no new tariffs on Dec. 15, 2) keeping additional tariffs, and 3) no deal going into the new year.

“I don’t think it would cause a big swing one way or another,” he said. “I think they would say, obviously negotiations are still going on. The reason you’ve had two pretty significant down days is, people were believing there would be a deal by the end of the year. Now, that’s clearly in doubt and that’s where we’re going.”

If additional tariffs are put on Dec. 15, that is a different story: “Then there’s another sell-off. If they put on additional tariffs and he bumps them by 10% or 15%, a sell-off but nothing severe. 50% or something like that? Better put on your helmet,” Cashin said.

Despite signs that even a so-called phase one trade deal might not be achieved, bulls are still holding out the prospects that the markets might be mollified by some sign — any sign — that talks are continuing.

As the expectations for a trade deal diminish and the bar gets set lower and lower, some are finally starting to look at the long-run implications of this dispute, and that it may be a permanent part of U.S.-China relations.

Source: CNBC

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.