- Home

- >

- Fundamental Analysis

- >

- How to be profitable during recession

How to be profitable during recession

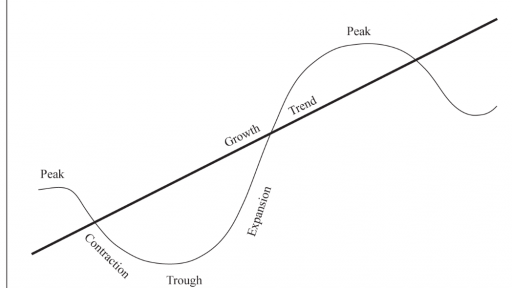

Business cycles are normal in the economy. Their repeatability may indicate the indicators that precede the crisis and what we should observe when the economic downturn is over.

We have 4 business cycle cycles: Trough, peak, expansion period, contraction period. The contraction of the economy comes after the peak period and before the recession. The economic expansion period comes after the recession period and before the peak period.

There are 4 main factors that vary during each period. They can tell us when to expect an upturn in the economy and when to expect contraction.

Early expansion of the economy: Gross domestic product, industrial production and other measures of economic activity are beginning to stabilize and rise. Employment in the economy: Although companies are not in a hurry to hire a new workforce, the dismissal of workers is declining. The business begins to look for temporary workers. The cost sector indicates an upturn. Initially, we see an increase in the cost of renting property and spending on durable goods. Inflation is still low.

Late economic expansion: Business activity is dwindling and economic growth shrinks. The business is actively starting to hire labor. Big increase in costs. Companies start investing in construction and other durable goods. Inflation shows a sign of life and is rising.

Peak: Economy shows first signs of slowdown. Business slows the pace of hiring a new workforce. Unemployment is still on a downward trend, but it is not declining so fast. Capital costs are still high but show a frequency contraction. Inflation continues to rise.

Economic shrinkage (recession): Economic activity shows a serious slowdown. Companies start to cut down on working hours and freeze new employees. Unemployment rises. The largest reflection is in the expenditure sector. Industrial production, housing rents, long-term commodity purchases, inflation reverses its upward trend.

From what has been said above, we can determine to some extent when we expect a slowdown in the economy and how to take advantage of it. Being traders and speculators, we can make a profit not only in an expanding economy, but even when the economy is in recession. When we see signs of weakening economic activity, we already know what's next. Withdrawal of capital from companies producing durable goods. From our point of view, this means shorts. Perhaps one of the first signs of a recession is a decline in investment in durable goods and constructions. Companies prefer not to invest much of their capital when there is a risk of a slowdown in the economy and consumer spending.

One of the first signs of economic recovery is hiring a new workforce. As workers are perhaps the most liquid assets of companies, renting shows that the company wants to increase its production in a short period of time. With that in mind, we can get hold of companies that produce fast-pervasive and liquid products.

Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.