- Home

- >

- Technical Analysis Education

- >

- How to trade the formation “Shooting Star” / Price action /

How to trade the formation "Shooting Star" / Price action /

What is formation "Shooting star"

"Shooting star" consists of a long upper shadow (at least two times greater than the body) and a relatively small body near the bottom of the candle. Body color does not matter and can have a small lower shadow.

"Falling Star" as many other formations of Japanese candles that will discuss the need to be marketed in the context of the market. True signal trading is obtained uptrend (figure below). Attempt to trade this formation at neutral market can be catastrophic.

"Shooting star" is reversible signal that unlike most other formations Price action will need confirming candle. Candle itself is a signal that does not guarantee that the price will reverse, and that the market should be reached resistance area.

How to trade the formation?

You must be prepared to risk at least the length of the upper shadow candle. Tip of the shadow is a good level to place stop loss because if the market break through this level then the signal was misleading.

In practice, even perfect-looking signals fail. Remember that the market may react in any direction. Successful traders are trying to stay out of the market until the odds are on their side.

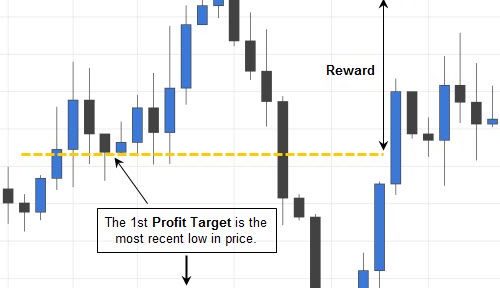

You must open a position if your potential profit is at least two times greater than the risk. How to determine the potential level to take profit? When trade "Shooting Star," the first level of profit taking is at a recent bottom (figure below).

The distance from the potential input to the nearest floor (the first potential level to take profit) should be at least two times greater than the distance between the entrance and stop loss-a (above Japanese candle + spread for forex). If this condition is not met avoid trade.

* Tip: How to reduce your risk and increase your profit potential? Price action Experienced traders know that the price more often returns at least 50% of the whole candle (including shade) before the sale, if you use signal properly. Knowing that 50% correction is a wonderful signal input (top figure). Also as you can see the first figure 50% correction is not always working.

In the figure above, you may have opened short, when the price reached 50% of the signal. Pocketing profits the most recent bottom is almost four times the risk.

As you can see "Falling Star" is a wonderful signal to monetize forex or other technical trade. It gives a good signal for profit taking in uptrend or a possible reverse signal to sell. Price action signals and this formation are very Appropriate for scalping because they are very important for short-term forecasts.

Unless you have professional ECN account or a very small spread of prices, using Price Action techniques under 10 minute charts it is not a good idea. Combining Price action techniques with good trading system can help determine the start of a long-term trend and be very profitable.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.