- Home

- >

- Technical Analysis Education

- >

- How to use the CCI indicator

How to use the CCI indicator

CCI indicator is useful for analyzing levels of oversold and overbought, but lagging its haraker makes it unreliable signal generator to buy or sell.

Brandon Wendell, a longtime analyst and trader on Wall Street.

The first thing I want to mention the technical indicators is that they are lagging behind and are not essential in deciding trading. In other words, when the signal to buy or sell, it will be at least one candle (schedule with Japanese candles) after optimal input trade.

So how can we use these indicators? They can be useful as an additional tool to support trading decisions. The discovery of divergence in any indicator or determining the situation of svrahpokupni or oversold levels help to identify certain areas more likely to make the price upward movement or downward.

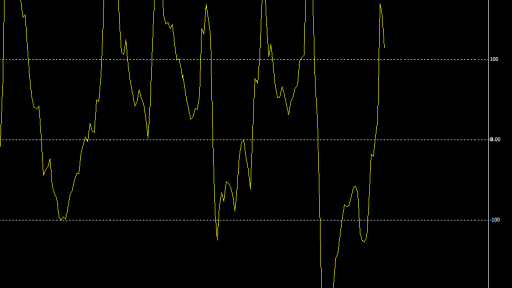

Referring to oversold levels and overbought should explain what they mean. CCI indicator is in the group of indicators known as oscillators. They usually have levels that highlight areas of oversold or overbought.

In CCI, the price of the instrument is overbought when the indicator is above level 100. This means that the price has risen so much so fast that it has deviated from the average price a lot more than normal. There is a high probability that this movement is unsustainable and that it will revert to the channel surrounding the average prices.

The oscillator oscillates above and below zero. When there is a line below -100, then it is said that the tool is svrahprodvan. Its price has fallen to a point of departure from your average sitoynost, ie is unsustainable and is likely to return to their average values.

Overall CCI serves to measure how far to move the price the price of the average values. If we are in a time of overbought or oversold, the price will be located outside the norm of standard deviation.

Traditional signal to buy or sell is crossing the line of price levels or -100 to +100. As you yourself to follow these signals are usually either too late or false.

Then how to use such an indicator? I use it in two ways. First, I think I have a better chance for successful marketing, buy from a starting level of upward movement when CCI is in the oversold zone, but usually buy when the price is in the area of demand and not wait for confirmation of the indicator signal as it slows down. Will also feel more comfortable if I sell in downtrend and CCI in oversold area, but can not wait for the traditional sell signal as it will sound very late.

Probably the best signal that CCI may submit is when you get to the line of divergence of the price chart. In a strong uptrend, where the price makes higher highs and lower lows, CCI should move with the same trend. If the price moves upward in a downward trend of higher order and CCI makes the same or lower highs, as he did at the previous peak in prices, it is a strong sell signal for me.

So I use the CCI indicator to help me to confirm the inputs and outputs of the position, but never as a major factor in the decision.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.