- Home

- >

- Daily Accents

- >

- Hysteria over negative sterling story will fade in 2017, says hedge fund manager

Hysteria over negative sterling story will fade in 2017, says hedge fund manager

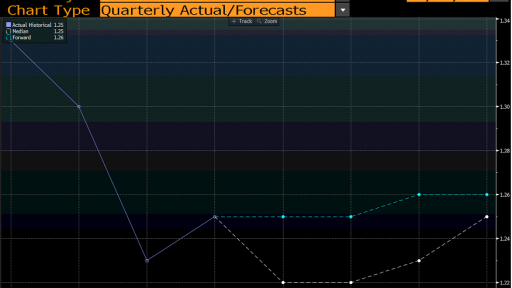

Sterling's sharp plummet in the wake of the EU referendum last June has only made it a more compelling opportunity, says the managing director of a long-established currency hedge fund.

"We're very constructive on sterling. We were bullish on the U.K. economy prior to Brexit and the lower sterling levels have just made it more attractive as entry levels. We do expect sterling to perform well throughout 2017 and also into 2018 if it looks like the momentum on the negotiations is going favorably," Mark Farrington, managing director at Macro Currency Group, told CNBC on the sidelines of the Investors' Choice Awards in London on Thursday evening.

"There has been a lot of hysteria around the negative side of the story and not as much energy invested in looking at the potential positive surprises. More than likely that research will be done this year so I think you'll start to see everything from the think tanks to the political parties themselves starting to emphasise the potential for positive surprises and the market will take the cue from that," he added.

"It's a very late cycle bull market in the U.S. dollar. We believe this is one of the dollar supercycles that we've seen typically over the last 40 years that lasts from 5 – 6 and sometimes up to 8 years," he posited, adding that the currency's strength reflected both structural and cyclical push factors.

"It will be a dollar overshoot by the end of the day and if the fundamentals remain in place, it is unlikely to resolve itself through a change in economic fundamentals. It could very well take another coordinated political intervention to reverse this dollar-up trend," added Farrington, pointing to the Plaza Accord of 1985 as an example of such an intervention.Highlighting the ongoing divergence in the interest rate trajectories of the U.S. and its main trading partners, the macro-focused investor unpicked the key factors driving the euro to its current valuation level.

"We think the euro is close to fair value but should be trading cheap to fair value because of a number of fundamental weaknesses and the unresolved stress on monetary union itself," argued Farrington, noting the uncharacteristic rapidity with which the European Central Bank (ECB) intervened this month to reverse a run-up in the currency after the market interpreted the central bank's message as more hawkish than it had apparently intended.

Farrington has a long and distinguished track record as a discretionary macro trader and while his fund incorporates computer strategies into its investing process as an aide to decipher and act on longer-term trends, he believes there continues to be a clear role for humans in the investing game, despite the rise of both passive and artificial intelligence trends in the asset management world.

"We're still quite a long ways off before machine learning is advanced enough to replace the discretionary fund manager because everything that we do is forward-looking, we're predicting structural breaks, political events," he explained.

"By definition, machine learning is a momentum concept…so it is always lagging."

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.