- Home

- >

- Daily Accents

- >

- ICO have raised more capital than VC funding

ICO have raised more capital than VC funding

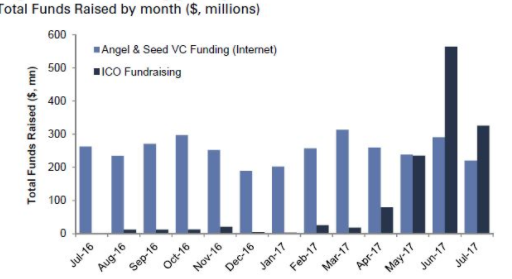

The amount of money raised by cryptocurrency and blockchain start-ups via so-called initial coin offerings (ICOs) has surpassed early stage venture capital (VC) funding for internet companies for the past two months.

ICOs are a way for start-ups to raise money from users, similar to crowdfunding, by allowing them to buy a stake. In return, the user will receive a token or digital currency, which are equivalent to shares in the firm. ICOs are popular among cryptocurrency and blockchain start-ups and have exploded in the past few months.

The total amount of money raised via ICOs in April was just under $100 million, but by May this had more than doubled to almost $250 million, according to Coinschedule, a website that tracks such data. In June, ICO funding had hit over $550 million and it was the first month ever that it surpassed angel and seed VC funding. This was noted by Goldman Sachs in a note released Tuesday.

But ICOs have received a lot of criticism and are under scrutiny from regulators. The Monetary Authority of Singapore (MAS), said in a recent statement that ICOs are "vulnerable to money laundering and terrorist financing risks due to the anonymous nature of the transactions, and the ease with which large sums of monies may be raised in a short period of time."

"Strict regulation comparable to the IPO business to protect investors is required," Oliver Bussmann, a former chief information officer at UBS

Source: Bloomberg Pro Terminal

Trader Bozhidar Arabadzhiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.