- Home

- >

- Daily Accents

- >

- If you notice a rise in coffee prices, blame climate change

If you notice a rise in coffee prices, blame climate change

Coffee farmer Masumi Kondo wrapped himself tight in the warm blankets during the cold nights of 1970. Then he began to plant and grow coffee in the Franca region in the Brazilian state of Sao Paulo. Now, thanks to the warmer weather, he places the air conditioner more and more often.

Not only farming rotation changes for farmers in response to climate change. The rise in temperatures reduces the diversity of wild-type plants, which is the most famous coffee seed. From Brazil to Ethiopia and Kenya, farmers move higher up the hills and mountains and develop new methods and technologies to keep crops and profits, of course.

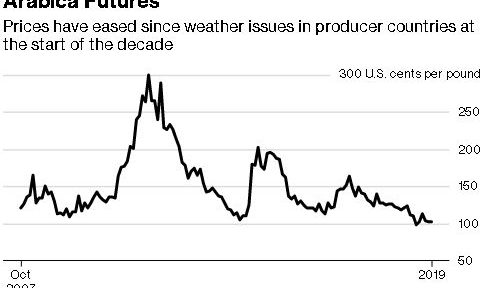

It is expected that in the next 70 years the places where it is possible to grow Arabic naturally reduce by up to 50%. Today's abundance of seeds that maintain low prices for the end product - coffee can lead to price reversal, as climate change reduces the potential size of new crops for years to come.

Seeds of Arabia are the most common coffee source in the world, growing in cold regions with prominent rains and dry seasons. They need a normal temperature range of 15 to 24 degrees Celsius. If it's too cold they freeze. Too warm the quality of coffee. The taste of coffee depends on the "perfect nights".

It is farmers who notice the changes in the plant because of the rise of temperatures. In excessively warm weather, crops also wither and wither faster, which reduces the potential yield. Productivity has decreased significantly already. The heat is drying up and the valves begin to decrease. Now their farms have to constantly think about buying new land with more normal conditions.

Wild Arab is the most traded coffee in the set and is placed on the list of endangered people. In the coming years, manufacturers will have to focus on the more flexible Robusta seed, which can grow in warmer places but also has a stronger flavor and flavor. With the disappearance of the Arabs, farmers also have fewer genetic options to adapt the plant to the different climatic conditions.

Arabic is of particular importance for Ethiopia, the largest coffee maker in Africa. Farmers there report that climate change has limited growth because of the more dry season and the average annual temperature has risen by 1.3 degrees Celsius from 1960 to 2006.

As a result, Ethiopia may lose about 60% of the land where it is possible to grow coffee by the end of this century. This will be a huge blow for the country that produces 7.5 million sacks of coffee per season, which is 4.4% of the world's supply. Despite the changes in the climate, the forecast is that for the 2018-2019 season the supply will be 167.5 million sacks, which is 1.5% more than the previous year. This will be the second year in which prices will remain subdued.

Arab futures have fallen over the past weeks due to the strong rainy season in Brazil and Vietnam, which signals a sufficiently saturated coffee market. Arabia is down 18% from 2018, while Robusta, which is used for instant coffee, is down 11%. The short-term effects of time will affect the world's coffee supply, and this worries traders at the moment instead of the long-term effect of climate change.

In Brazil, they have already taken measures to prevent the negative effects of changes in time by sowing more trees and areas where they were previously cut off.

Moving farms to higher and cooler places can keep some of the larger farms in the world. In Ethiopia, for example, the average height that the farms would raise would be 32 meters per decade, raising the 2200 meter to 3300 meter limit.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.