- Home

- >

- Fundamental Analysis

- >

- Inflation in the euro area continues to be at uncomfortably low levels

Inflation in the euro area continues to be at uncomfortably low levels

The euro-area economy is recovering, and yet inflation is not responding. The European

Central Bank’s conundrum isn’t unprecedented but it’s looking increasingly odd when compared with the way inflation behaved after other sharp downturns in Europe and elsewhere in the past. That should cause the Governing Council to wait a long time before it starts withdrawing monetary stimulus.

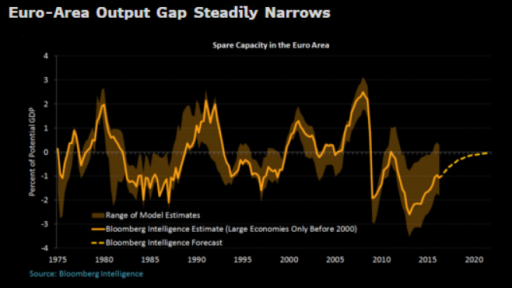

The euro-area economy expanded by 0.5% in each of the past two quarters that’s fast enough to push unemployment down and narrow the gap between actual and potential output. That’s been going on for the last few years the recovery had reduced the slack in the economy to about 1% of potential GDP by the end of 2016 from about 2.6% in early 2013.

At the same time, inflation remains uncomfortably low. Supercore inflation, which excludes volatile package holiday prices, has been little changed for about three years around half the ECB’s target. This measure includes just the categories of prices most closely related to the size of the output gap.

Services inflation is also normally a good measure of domestically-generated price increases. After ignoring the recent spike, induced by the abnormal timing of the Easter holidays, a similar picture emerges for that measure. The story is little different for the core figure.

Underlying Inflation Shows No Signs of Life. To understand whether this situation is normal, it’s worth

asking whether the recovery has been unusually slow. The International Monetary Fund describes long occurrences of weak demand as "persistent large output gaps" (PLOG). These are defined as periods when actual output falls short of potential output by at least 1.5% for at least eight quarters. The PLOG

created by the euro crisis wasn’t unusually long. The length of time that inflation continued to fall was also not particularly exceptional.

What really stands out about the euro area is the failure of inflation to recover. BI Economics looked at the PLOGs in the countries examined in the IMF study on the topic and the behavior of inflation excluding energy and food. The cyclical component of that measure of price increases, which is the

residual after removing the trend from the time series, has recovered on average only nine quarters after the output gap reached a floor. A recovery is defined as a 0.5 percentage point rise of the cyclical component from its trough. That has yet to happen in the monetary union and the measure of spare capacity troughed 14 quarters ago.

Lack of Inflation Recovery Begins to Stand Out Having said that, the euro area’s situation isn’t without precedent. The inflation recovery took 25 quarters to occur in the U.K. after the global financial crisis struck and significant price increases took 29 quarters to materialize in the Netherlands in the early 1980s.

The sluggishness of inflation is why the ECB has continued to loosen monetary policy and the reason that it’ll be slow to move toward the exit from that expansionary mode. BI Economics expects the ECB to be pleased enough with the speed of the recovery in aggregate demand to make an announcement on tapering in September reducing the amount of monthly purchases in January would slow тhe pace at which the Governing Council is adding stimulus to the economy. However, it’ll need definitive signs of an acceleration of inflation before it begins to actually withdraw stimulus. BI Economics expects that to take the form of an interest rate hike, starting with the deposit rate, but that may not happen for another two years.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.