- Home

- >

- Managing risk

- >

- Inverse ETFs as a Safe Haven tool in market uncertainty

Inverse ETFs as a Safe Haven tool in market uncertainty

Hedging is a powerful risk minimization strategy for equity investments that is backed by other assets in a portfolio. Inverse (reverse) ETFs provide low cost to investors wishing to fully cover their portfolio or a specific segment of it. Hedging is like a portfolio insurance similar to a home insurance or auto insurance, which covers the costs of a bad coincidence.

How exactly Inverse ETFs work

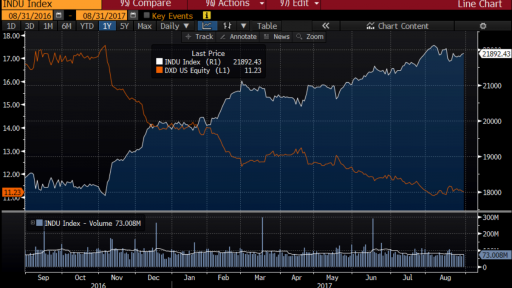

The inverse ETF follows the development of an index, and when the index starts to fall, the ETF increases its value. For example, when Dow Jones corrects and we have shares of it in our wallet, we also should to have an ETF, such as the DXD - ProShares UltraShort Dow30, which increases its value during a down trend. Some of the reverse ETFs are changing even 2 or 3 times more than the index they follow. These ETFs require constant and frequent rebalancing and very often lose much of their value in a rapidly growing market. For this reason, the purchase of an ETFs is required at some point.

Here's a practical example of how to use reverse ETFs

Let's say we own a $100,000 portfolio invested in 20 of the Dow Jones companies, but you strongly believe the market will adjust. One of the options is to sell your shares and the other is to hedge them through the ETF. In the second case, you'll need $100,000 to buy a reverse ETF on Dow Jones, like DXD - ProShares UltraShort Dow30. If the market goes in the opposite direction, as you think you will earn a profit on your ETF position to make up for your losses on the stock. On the graph you can track the development of Dow Jones and DXD - ProShares UltraShort Dow30, where the opposite correlation between the two assets is clearly visible. In this case, you will have liquidated the entire market risk and lock the realized profit from the shares until the correction goes through.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.