- Home

- >

- Stocks Daily Forecasts

- >

- Investors Are Now the Most Bearish on Global Economy Since Crash

Investors Are Now the Most Bearish on Global Economy Since Crash

Pessimism towards the global economy is compounding against rising trade tensions and expectations that the US Central Bank will continue to tighten monetary policy despite the uncertainty of stock markets.

Fund managers surveyed by Bank of America Merrill Lynch this month are holding cash as they have not been more bearish to global activity since the last decade.

"Investors are bearish to global growth," said Michael Hartnett, chief investment strategist.

The net share of investors who believe that growth will shrink over the next 12 months has reached 38% - this is the most negative view since November 2008. Global profits are also expected to fall.

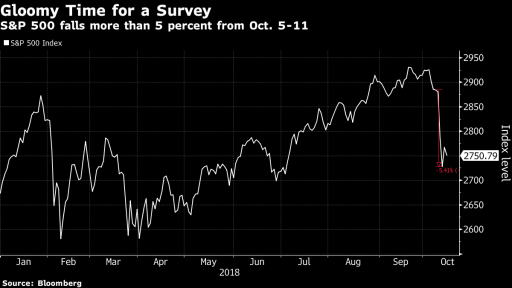

The long positions of the FAANG group, made up of Facebook, Amazon, Apple, Netflix and Alphabet, as well as its Chinese counterpart, BAT - Baidu, Alibaba and Tencent, were considered the preferred trade for 9 consecutive months. These data were collected between 5-11.10.2018, a period in which US stocks collapsed by more than 5%, with most of the aforementioned shares leading to losses.

Hedge Fund managers reported buying energy and material stock shares and removing names linked to growth in October, with net exposures to the technology sector down 6 percent. Cash levels remain stable at a high of 5.1%.

But this time, Fed is not here to calm investors. On the contrary, the number of traders who believe that the quantitative easing is the biggest risk is almost doubled to 31% at the moment, although the trade war remains at the forefront of danger.

Tightening on the part of the Fed "causing U.S. hopes to wane,," said Hartnett. And, according to the majority, the S & P 500 should fall to at least 2,500 before the Fed drops interest rates.

Original post: Investors Are Now the Most Bearish on Global Economy Since Crash

Source: Bloomberg Finance L.P.

Charts: Used with permission of Bloomberg Finance L.P.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.