- Home

- >

- Daily Accents

- >

- Investors are worried about the increasing prospect of global recession

Investors are worried about the increasing prospect of global recession

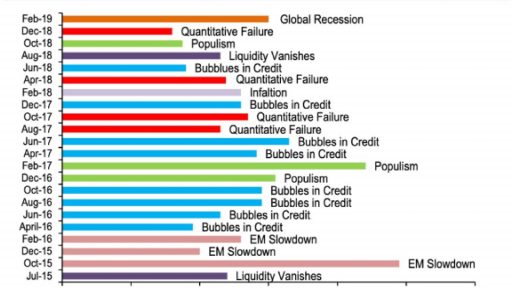

Risks of recession are in the minds of the investors mostly with fears about growth, according to a Bank of America Merrill Lynch survey.

Corporate bond markets decreased at the end of 2018 with volumes getting smaller amid market stress coming from the US-China trade conflict and slowing global growth. These fears appear to have manifested themselves clearly in the minds of the surveyed clients, with global recession now being the largest concern in investors minds.

30% of those surveyed said that a global recession is their biggest fear, the biggest number of survey participants naming a single issue since the summer of 2017.

Some decreasing figures out of Europe, like Italy and Germany, as well as worrying Chinese data has played on the minds of investors in the last few months. Europe's largest economy, Germany, just avoided a technical recession in 2018 when automotive sector had difficulties.

Investors are also concerned about the US's fourth quarter GDP numbers that have to be released soon, which are expected to show a decline from the growth highs of the second quarter of 2018. The slowing global picture is a big problem for the US which is getting more vulnerable to the turmoil of other economies.

Tighter economic and financial linkages today have likely increased the risk from foreign spillovers. The key to getting Europe out of its current malaise is increased stimulus out of China, according to the surveyed group of people. China's own debt issues are well known, but an improvement in the country's import data, with particular reference to German cars, could help the ailing eurozone.

Chart: Bank of America Merrill Lynch Global Research

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.