- Home

- >

- Fundamental Analysis

- >

- Investors made a mistake, but there’s nothing wrong with that

Investors made a mistake, but there's nothing wrong with that

After months of mixed signals, investors are becoming more optimistic. From a real point of view, there is no well-reasoned explanation for the change in mood, but that does not mean that it is wrong.

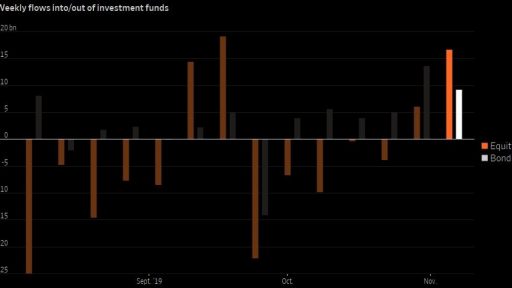

2019 is set to be a strange year: the S & P500 has set several record highs, despite disagreements between the US and China and signs of a slowing global economy. Negative circumstances that led managers to flee stocks. They spent their money either in bonds or just standing in cash. Cash outflows were highest in October after poorer production data emerged.

However, in the last few weeks, everything has changed.

The S & P500 hit a new record late last week, but this time because of cash flowing back into equities. The pace at which flows flowed into stocks instead of bonds was the fastest for the first time since September.

Markets are also beginning to decline and the likelihood of recession is increasingly bold and aggressive. If economic growth continues to slow, the Federal Reserve will likely continue to cut interest rates. Interest rate derivatives now estimate the chance of interest rates not changing at 52% by the end of 2020.

However, in the real world of the economy, things have not changed much. Economic data have not changed so much. Trade talks have become more constructive as the 2020 presidential election approaches, but investors are already expecting this development.

Either investors panicked too long before and are now correcting their mistakes, or their outburst of optimism will now turn out to be false and naive. For now, the signs indicate that this is the first. The new mood is now more coherent with the market situation. Previously, stocks were able to record rallies in the face of mounting economic turmoil because investors were running into defensive stocks with sustainable returns. As a Utilities sector that is considered to be untouched by economic turmoil.

The combination of a rising market and a run toward defensive stocks is unusual: Since 1999, defensive stocks have performed 24% better than markets when they rose. It once happened in 2007 just before the Great Recession. Since then, however, this model has signaled only excessive caution. There is little point in investors expecting an immediate recession to run in defensive stocks: By contrast, bonds continue to move in parallel with stocks.

Both the US economy and corporate profits remain strong. Government spending covers the holes in the manufacturing sector, allowing households to save without stifling consumption. Last season's report, contrary to expectations, confirmed that analysts were too negative: 75% of companies in the S & P500 would have expected.

However, it should be noted that revenue expanded only 3.2% in Q3 compared to the same period last year - the slowest pace since Q3 in 2016. This suggests that investors still remain reserved in their expectations for how much more will increase the prices in the near future. Especially with the slowdown in the Chinese economy, which is expected to continue, weighing heavily on exports, even if tariffs are lifted.

After all, there is little evidence to support the view that mood swings are caused by irrational exaggerations. The only irrational thing to note is the excessive investor concern over the last few months.

Source: The Wall Street Journal

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.