- Home

- >

- Fundamental Analysis

- >

- Investors pull record amounts out of US stock funds

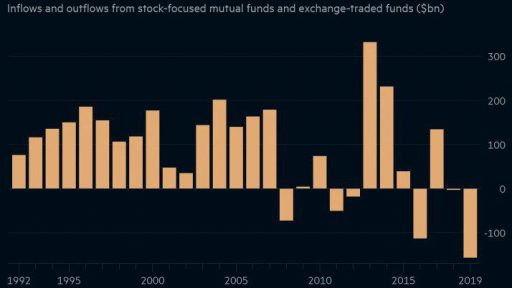

Investors pull record amounts out of US stock funds

That means the most unloved bull market in memory chugs along. Since March 1, 2009, the Standard & Poor's 500 stock index is up 435% while investors continue to reduce their exposure to stocks.

Despite 2019 turning in the strongest year for stock investors in the last six, investors have been selling stock mutual funds at a record pace. So far, equity mutual funds and exchange-traded funds have lost over $135 billion to withdrawals – the largest amount since Refinitiv Lipper began tracking the flows in 1992.

First and foremost, when markets get frothy, one of the catalysts that drives stocks higher is cash moving from the sidelines into the stock market. Think FOMO on steroids. Yet, we have seen the opposite occur over the last few years. Indeed, as stock prices have risen, so has cash.

According to Strategas Research Partners’ Jason Trennert, one-half of the S&P 500’s total return since 1926 has come from dividends. And in the decade beginning in 2000, basically, the only return investors received came in the form of dividends, according to Trennert. Dividends matter.

Additionally, stock buybacks are providing a floor to stock prices by reducing the supply of individual shares. Trennert’s work has also shown that in 2018 “buybacks accounted for $573 billion of net new demand for equities.” Compare this with equity ETFs, which generated $210 billion in demand and stock mutual funds, which were responsible for $124 billion of net sales.

Dividend growth is around 7.2% in recent years and payout ratios are near historic lows. This gives companies room to grow the dividends further. Importantly, dividends provide investors with information: Large companies pay and raise the dividend at a rate based on what they believe long-term sustainable earnings growth to be. The dividend is a commitment; buybacks are opportunistic. But when combined, the two produce what is called the shareholder yield. That number is currently 5.1% for the S&P 500 which is over 3 percentage points higher than the yield on the 10-year Treasury.

Real yields on bonds – the after-inflation return – is just modestly above zero. And, while we are on the subject of inflation, despite expectations that full employment would drive prices higher, inflation remains elusively tame. The Fed is unlikely to raise rates in such a benign environment.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.