- Home

- >

- Daily Accents

- >

- Investors with renewed interest in the markets of developing countries

Investors with renewed interest in the markets of developing countries

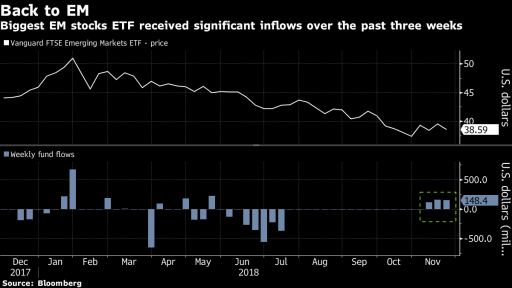

Investors' return to EM markets grew last week after traders diversified against stock price depreciation and indices, even though there were bullish signals from several major investment firms.

The injection of money into US Treasuries that invest in developing countries as well as those targeting specific countries has reached $ .128 billion at the end of last week. That makes $ 20.5 billion for the whole year.

Institutions such as Aberdeen Standard Investments, Schroders Plc, Goldman Sachs Asset Management and BlackRock Inc. have a renewed interest in the EM sector after the Fed hinted that they could pause in monetary policy in 2019 due to slowing economic growth. While some analysts remain cautious, Morgan Stanley has been quite positive about the EM markets and welcomed the return of investors to these markets. Their forecast can be read here.

"The weakening of the dollar next year, the milder tone of the Fed and the possible happy development of US-China events at the G20 summit are boosted by developing countries." - says Greg Lesko, money manager at Deltec Asset Management.

Vanguard FTSE Emerging Markets ETF has attracted US $ 421 million in November and the iShares core MSCI Emerging Markets ETF - $ 2.2 billion.

While the growth of cash for now remains below $ 47 billion last year, investor activity towards these ETFs has increased, and they are beginning to feel more confident, especially after the strong sell-off of EM Markets at the end of the first half of the year , where the investment outflow was $ 10 billion.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.