- Home

- >

- Stocks Daily Forecasts

- >

- Is it time for investments in gold mining companies?

Is it time for investments in gold mining companies?

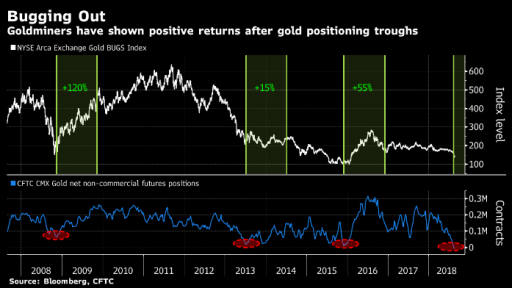

Investors looking for an autumn trade recommendation could be targeting purchases by US gold mining companies. What does the statistics say up to now? Over the past three times, when gold bets were so low, the NYSE Arca, Gold BUGS index, which tracks the gold mining sector, recorded double-digit growth. The average annual return in 2008, 2013 and 2015 is equal to 60%.

In the long run, gold is on a downward trend starting in September 2011. On weekly schedule, however, we see several technical signals that suggest a short-term reversal of the downward trend. DeMarker's weekly graphic oscillator forms W in oversold territory. On the graph and on the bottom panel of the oscillator, I have noted the cases in which the DeMarker W-formation was preceded by a whip or sword short-term reversal. The current signal increases the chance of short-term reversal. On average, the reversing trend is about 2 months after the W bottom formation is formed. Also, the closer to each other are the bottoms of the W-formation (or the M-formation, the more reliable and more profitable the signal is, this is our conclusion from observations on the GOLD market.

GOLD: signal for possible reversal in the coming months

Source: Bloomberg Finance L.P.

Chart: Used with permission of Bloomberg Finance L.P.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.