- Home

- >

- Commodities Daily Forecasts

- >

- Is it time for Short on oil, and how to get best price?

Is it time for Short on oil, and how to get best price?

Let's start with the latest data published by the United States. The country's energy ministry publishes data on oil reserves in the country, marking a decrease of -2,435M barrels per day. On the other hand, a number of energy ministers of OPEC member states have expressed their intentions to extend the abstraction program by the end of 2018 in the last two weeks. Considering these two bull market catalysts, oil had to rise sharply. The fact, however, is that the price of the raw material decreased despite the positive sentiment.

Why? The main reasons are three, firstly, the fact that US oil exports manage to cover all the efforts of producer countries, and in the last two weeks even exceeds the shortened output from the Arab world. In the last week, net oil cuts in the oil producing countries amounted to 1.80m barrels per day, while US net exports totaled 2.133m barrels a day => once again, a surplus in a serious amount appeared.

The second major reason is shale gas, which due to low oil prices we did not mention soon. Shale gas extraction technology requires the WTI price to be $55 or more per barrel. At this price, shale gas investment is becoming profitable, and many US refiners are targeting shale fuel instead of crude oil. This leads to an extra surplus of black gold and the market should be balanced.

The third reason is going to happen in the future, as I mean that many of the economies entering OPEC are beginning to gasp, both from low oil prices and from the cuts they have to make to keep the price "high" ". With increasing US exports, all this pressure will sooner or later lead to a serious deficit in the balances of the economies in question, and they will be forced to increase their production => more global surplus and lower oil prices.

Here's a strong foundation for Short. Let's look at the price technically.

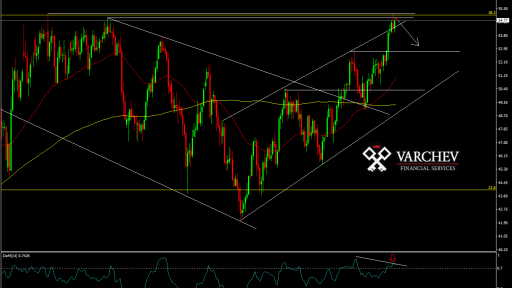

Over the last five months, the price has moved upward, reaching levels of horizontal resistance, coinciding with a 38.2% correction of long-term downward movement. This level will be tested for the second time in the last 12 months, and given the strong foundation, we expect the price to not exceed a long-lasting $55/$56 a barrel. Dem (14) forms a reverse divergence over the price by turning and pointing down into an over purchase zone - negative for the price. The price forms an Inside Bar formation in a resistance zone - a negative Price Action Signal.

Short of current levels will be favored with a SL at around $56.50, as this is a big fight between buyers and sellers, and balancing the market itself requires more time. Because of this, spikes and false breakthroughs are possible, which we can avoid with a remote SL.

Alternative scenario: If the price breaks through the resistance zone and stays there in several consecutive bars, the negative scenario will break and WTI is more likely to enter consolidation or a suitable foundation to continue the upward movement.

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.