- Home

- >

- FX Daily Forecasts

- >

- Is it time to look for buy on AUD

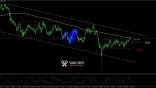

Is it time to look for buy on AUD

According to AMP Capital, it is time to close long on NZD and buy AUD.

NZD rose 7.1 percent against the Australian from the bottom in October to the mid-April tops, but there are several signs of reversing the trend that is worth mentioning.

Although already trivial, everything is rooted in central monetary policy and inflation in the countries. So why go to AUD and sell NZD? Westpac Banking Group is of the opinion that stable iron ore prices are at the root of rising appetite risk and demand for AUD, and RBNZ's low interest rates nurture short positions in the NZD.

In addition, low inflation in New Zealand suggests that an increase in the country's key interest rate is unlikely. At the same time, in Australia, the central bank raised its forecasts of reaching target inflation of 2% and acknowledged that such inflation would require stricter monetary policy.

On the other hand, improving Australia's government balance will strengthen the attractiveness of Australian debt and we will probably see a transfer of funds from New Zealand to Australia.

Source: Bloomberg Pro Terminal

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.