- Home

- >

- FX Daily Forecasts

- >

- It seems Trump has completely confused Bank Of Canada’s plans

It seems Trump has completely confused Bank Of Canada's plans

Bank Of Canada will seek to weaken the currency as Canada's economy shows clear signs of slowdown, said Peter Kotsopoulos, CEO of MFS Investment Management Canada, specializing in the trading of fixed income instruments.

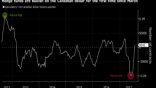

The Canadian dollar declined by nearly 3% against the dollar this year, as traders expect Bank of Canada manager Stephen Poloz to aggressively tighten monetary policy. This suggests that, despite the momentary downward momentum, the Canadian will be able to finish the year on a positive territory. In theory, but as always, things are not that simple.

It seems that traders have paid too much attention to the hopes that BoC will undertake an aggressive tightening of monetary policy. Yes, in September last year the bank undertook an unexpected raise, but Polos said that this was the result of good economic data and the future decisions of the bank would depend on them alone.

The consensus forecast for USD/CAD is at the end of 2018 to see a price of about 1.2400, but Kotsopoulos and Polos' behavior claim the opposite. "Polos is realistic about the economic situation in the country and will not hesitate to loosen monetary policy in an effort to improve exports," added Kotsopoulos.

In addition to expectations of slowing domestic growth, fears about the future of NAFTA will help reduce the Canadian currency, but cardinal changes will lead to a significant drop in country exports. This, in turn, will lead to huge costs for the restructuring of the country's exports and will generally aggravate the economic environment.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.