- Home

- >

- Fundamental Analysis

- >

- Italy debt highest since Mussolini

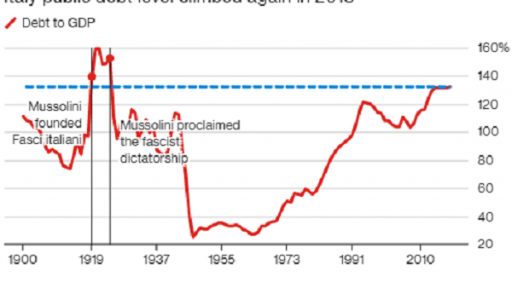

Italy debt highest since Mussolini

A year after the elections that led to the Italian populist party's inauguration, the economic outlook is more uncertain and the warnings in Europe are growing more and more.

The third largest economy in the eurozone has experienced a prolonged decline in production in February, days after confidence data has raised concerns that the recession is approaching. The European Commission repeated the criticism of the government's policy and added that the consequences could affect the rest of the continent.

The country's highly dependent country is obsessed with the global slowdown that has paved the way across Europe and left a hole in production. Italy's problems are compounded by the coalition's expansionary budget, designed to meet expensive election promises.

This left the economy almost stagnant this year along with stubborn double-digit unemployment and no progress in reducing the huge debt burden. Economists predict a 0.1% growth this quarter, but many say there is a high risk of a further contraction in the economy.

"The prospect remains very uncertain and Italian companies seem to be beginning to understand that," said Vincenzo Longo, analyst at IG Markets in Milan. "The main risks remain related to the international context as well as to the domestic, where political uncertainty remains under the lure of investors."

Source: Bloomberg Finance L.P.

Graphics: Used with permission from Bloomberg Finance L.P.

Original Post: Italy Is Still in the Danger Zone, and Europe Is Nervous

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.