- Home

- >

- Fundamental Analysis

- >

- It’s not just Italy — France’s 2019 budget is also a concern for Brussels

It's not just Italy — France's 2019 budget is also a concern for Brussels

Markets have been on the edge regarding Italy's future spending, but there are other countries challenging European fiscal rules.

France, the second-largest economy in Europe, received a letter from Brussels last week, warning that its planned debt reduction in 2019 does not respect the proposals that Paris had agreed previously with the EU. Spain, Belgium, Portugal and Slovenia were also effectively told off by the EU.

In the case of France, the 2019 budget plan sees its structural deficit (the difference between spending and revenues, excluding one-off items) falling 0.1 percent this year and 0.3 percent in 2019. Paris had agreed in April to an annual reduction of 0.6 percent of GDP (gross domestic product) for its structural deficit.

Though the tone of the warning from Brussels to Paris was softer than the tone towards Rome, the two countries have perhaps more similarities than differences.

The French 2019 budget "shows that the government relies heavily on very optimistic revenues to achieve fiscal consolidation and that spending is out of control again," Daniel Lacalle, chief economist and investment officer at Tressis Gestion, told CNBC via email.

Italy has also been criticized for having very upbeat economic forecasts in its 2019 budget plan.

"In the case of France, it is a very difficult budget to accept by the European Commission because France has not had a balanced budget since 1974 and has missed its own deficit targets more than eleven times," Lacalle added.

Data from the European statistics agency, Eurostat, shows that since it started collecting French data in 1978, France has never registered a budget surplus. Italy, which has provided data since 1995, has also never presented a budget surplus.

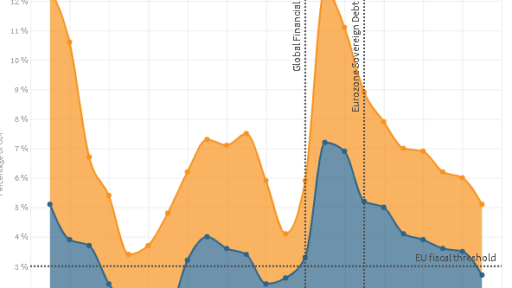

A report from credit ratings agency Moody's, released Tuesday, showed that nominal budget deficits (the actual deficit without adjusting for the impact of inflation) in the euro area have dropped since 2008. However, "the aggregate share of mandatory spending in euro area budgets has actually risen to 76.3 percent of total spending from 74.5 percent in 2008."

"This increase mainly reflects a rise in spending on social security and assistance, pensions, education and health care," the report said.

France, traditionally seen as a welfare state, has promised in its 2019 budget plan to reform the way benefits are calculated.

According to Vincent Juvyns, global market strategist at J.P. Morgan Asset Management, the commitment to reforms is one of the big differences between France and Italy. While the government in France wants to go ahead and change certain areas, the executive in Rome has backtracked on key reforms that the previous government had implemented, including an overhaul to the pension system.

Florian Hense, an economist at Berenberg, also told CNBC via email that at a first glance the French budget might be even worse than Italy's, but added that the big difference is the rhetoric coming from other countries.

"Taken at face value, the French budget plans do not look much better than the Italian's, or in fact worse. But, while France is credibly working on improving its long-run growth potential (by strengthening both the demand and supply side of the economy), Italy is doing the opposite (think a lower retirement age and fiscal spending channeled through to consumption rather than investment)," he said.

Overall, France has promised to lower its total government debt in 2019, but by a very thin margin. While France's debt is set to hit 98.7 percent of GDP in 2018, it is forecast to fall by 0.1 percentage points in 2019 to 98.6 percent.

Looking at Italy, the government said that the country's debt ratio will decline from 131.2 percent of GDP in 2017 to 126.7 percent in 2021.

Europe's fiscal rules suggest that countries should not exceed a debt ratio of 60 percent. Data from Eurostat has shown that both of these founding countries of the EU have struggled to keep their debt ratios below that threshold. But the situation seems far worse in Italy, where since 1995, debt-to-GDP has always been above 100 percent.

Despite the deviation from the rules, the European Commission has never sanctioned a member state, though it has legal ground to do that. However, the Commission has gone one step further on Tuesday in relation to Italy's latest budget — it asked for a resubmission, meaning that it does not think the Italian budget is good enough. This has never happened before.

Nonetheless, Italy keeps comparing itself to France. Deputy Prime Minister Matteo Salvini last month questioned on Twitter why Italy's 2019 planned deficit is a problem (which is set to be 2.4 percent) when France has breached the 3 percent threshold for years.

"But how, if France and Spain have been extending the 3 percent ceiling for years, nobody says anything, while if Italy tries to touch it to secure the country and boost the consumption of Italians is a problem?," Salvini said.

But Juvyns told CNBC that the French and the Italian economies are not the same, "because the debt-to-GDP level is different."

Source: CNBC

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.