- Home

- >

- Cryptocurrencies / Algotrading

- >

- It’s too soon to talk about “to the moon”: What is really behind the BTC rally

It's too soon to talk about "to the moon": What is really behind the BTC rally

The crypto market has made an unexpected turnout last week, with prices rising sharply.

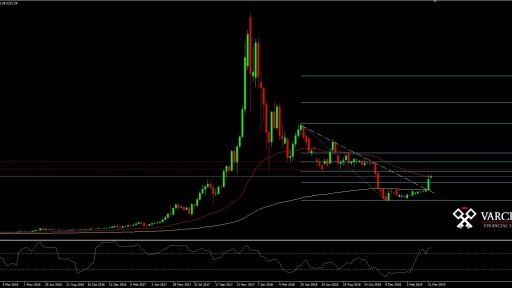

For only a few hours on April 2nd, the bitcoin price rose from roughly $ 4,100 to $ 4,800; from there, it continued to rise and reached approximately $ 5,260. Over the same period, Litecoin gained nearly 50% of its value, Bitcoin cash advanced by 80% since then.

The crunching market saw an increase of about $ 144 billion to $ 181 billion. The bitcoin dominance has stayed the same since the beginning of the month, suggesting that investors are bullish not only to the biggest cryptocurrency, but also to the alternative.

Why? Why - after months of tension now we see a recovery? And what does this mean for the future?

Many theories emerged, most of them quite unreal. However, Gabriel Dusil, co-founder of Adel, commented that there are several very logical reasons behind the rise of bitcoin.

"BTC jumped over 5K because of trading activity," Dusil said, adding that "someone bought bitcoin for $ 100 million through several exchanges (Coinbase, Kraken and Bitstamp)."

Indeed, Oliver von Labdsberg-Sadie from BCB Group said: "There is one order that is algorithmically managed through these three locations, from about 20,000 BTC." If you look at the volumes of each of these three exchanges - there were synchronized units of volume about 7,000 BTC per hour. "

Another factor that may be the reason for the rise of bitcoin is the stock of "not dug" coins, which are now close to half what they were at the beginning. Expectations are that they will be fully populated in May 2020. The closer we are to that date, the more interest we accumulate in buying the cryptocurrency and the retention for the future - when it will be much more difficult to get a bitcoin.

The third reason is simply the euphoria. Because bitcoin and other cripples have made positive moves recently, speculators believe they will be able to make a profit from this bumpy wave.

However, for now it is difficult to say how long and how much new capital will be retained. The market is very different from the end of 2017 when the big promotion happened. Practically, not many people had heard about bitcoin then; the upward spiral was boosted by ignorance and blind optimism.

Now, people are wiser. After seeing the impressive market crash that took place in early 2018, the world is much more skeptical of investing in these assets.

On the other hand, however, the bitcoin price may already be more stable because of the investment capital inflow. The risk that the bitcoin will simply disappear significantly decreases after the big players intervene.

Source: Finance Magnates

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.