- Home

- >

- Fundamental Analysis

- >

- It’s worth looking at energy and industrial sectors

It's worth looking at energy and industrial sectors

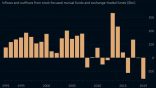

For those investors brave enough to dip their toe back in the stock market -- energy and industrial shares might be worth a closer look. Globally, both groups have fallen over 4 percent in the last month, almost 10 percent in the case of oil stocks, even as analysts increased their annual earnings per share estimates for the sectors by 3 percent or more. Consumer discretionary companies have also seen strong positive earnings revisions, almost 4 percent, though shares have fallen by 2 percent amid the recent market volatility.

What can we expect from the industrial materials industry. As we know, the biggest importer of industrial materials is China. Bearing in mind that the 2nd largest economy in the world is developing at an impressive pace, we expect an increased demand for industrial materials, which will raise the cost of the materials themselves. Companies in this sector will be forced to increase the extraction and processing of industrial materials, but as the cost of their products will be increased, we can expect to pour capital into them, which will ultimately increase the company's stock price.

The energy sector, in particular the oil industry, as we know, is performing well in recent months. With Brent and WTI prices above $60, oil companies have a steady revenue. However, this may change... shale companies in the US and Canada will change the rules in this market. Several years ago, in order for the shale producers to be profitable, the oil price had to be above $50 a barrel. But now the situation has changed quite a bit. With the rise of technology and extraction optimization, shale companies generate profits when the price of oil is over $30. This is significant difference, especially considering the agreement between OPEC and other major producers to curb up the price of black gold. The problem is that the United States and Canada do not participate in this agreement. So .. OPEC cuts production to rebalance the market, which raises the price of OIL. But this reduction is covered (to a certain extent) by the US and Canada. The US is expected to overtake the largest producer of crude oil, Russia, within a year. And we are asking ourselves the right question .. will the OPEC extend its agreement just to keep the price artificially elevated so the US and Canada can gain profits?

Source: Bloomberg Pro Terminal

Trader Bozhidar Arabadzhiev

Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.