- Home

- >

- Great Traders

- >

- James Harris Simоns- Codebreaker

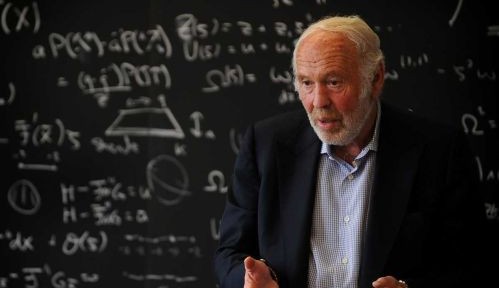

James Harris Simоns- Codebreaker

Harris James "Jim" Simons (born 1938) is an American mathematician, hedge fund manager and philanthropist. It is a code breaker and studied pattern recognition.

Simmons taught mathematics at Stony Brook University on Long Island in New York.

In 1982, Simons founded Renaissance Technologies, private hedge fund investment company headquartered in New York with over $ 15 billion under its management. Simonс is retiring at the end of 2009 as CEO of one of the most successful companies to hedge funds in the world. Net Simmons is estimated at 12500000 хиляди USD.

Simons lives with his wife Marilyn H. Simons in Manhattan and Long Island, and is the father of five children; two of his children died young in tragic obstoyatelstva- drowning and car accident.

Simons shuns the limelight and rarely gives interviews, citing Benjamin the donkey in the animal farm, explaining: ". God gave me a tail to keep the flies off, but I prefer to have a tail and no flies." In October 2009, Simonс announced that he will retire on January 1, 2010, but remained as chairman.

For more than two decades, hedge funds Simon, "Renaissance Technologies", who trades in markets around the world, employed mathematical models for analysis and execution of transactions, all very automated. Renaissance uses computer-based models to predict price changes of financial instruments. These models are based on the analysis of most data can be collected and then seek involuntary movements to make predictions.

In Renaissance work of non-specialists environments, including mathematicians, physicists, experts in signal processing and statisticians. Last fund company is an institutional fund shares (Rief). Rief historical cheers more famous "Medallion Fund" of the company, a separate fund, which contains only private money and the managers of the company.

"It's amazing to see such a highly successful mathematician achieve success in another area," says Edward Witten, professor of physics at the Institute for Advanced Study in Princeton, New Jersey, and considered by many of his colleagues for the most talented physicist alive and theorist.

In 2006, Simonс was named Financial Engineer of the Year by the International Association of Financial Engineers. In 2007 he earned personal income amounted to $ 2.8 billion and $ 1.7 billion in 2006, $ 1.5 billion in 2005 (the largest compensation among hedge fund managers this year) and $ 670 million in 2004 ....

Simons and his second wife, Marilyn H. Simmons, are co-founders of the foundation Simpson, a charity that supports projects related to education and health, in addition to research. In memory of his son Paul, who he had with his first wife, Barbara Simons, he established Avalon Park, a 130-acre (0.53 km2) natural reserve in Stony Brook.

In 1996, 34-year-old Paul was killed by a car while riding his bike near home. The other son, Nick Simmons, drowned 24 years ago during a trip to Bali in Indonesia in 2003, Nick has worked in Nepal, with Simpsons have become major donors to the Nepalese health services by Nick Simons Institute....

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.